Google's moat isn't its algorithm. Tesla's moat isn't its batteries. The strongest AI companies build advantages you can't see, copy, or buy. Yet Series B investors keep checking the wrong boxes while the real competitive advantages hide in plain sight.

This disconnect matters because revenue charts and user counts only tell you what happened, while invisible AI moats tell you what happens next. These hidden advantages compound daily through data loops, workflow lock-ins, and collective learning that spreadsheets never capture. The result is predictable: companies with weaker metrics but stronger moats win the long game every time.

We've identified five invisible moats that separate AI companies that last from those that won't, but first

What are invisible AI moats?

Remember when Google got so good at search that nobody could catch up? That's an invisible moat. You couldn't see it from outside, but every search made their algorithm smarter, which brought more users, which generated more data. The cycle fed itself.

AI companies have the same opportunity, except the cycles move faster. Your product captures unique data from customers, which improves your models overnight. Better models make customers happier, and happy customers generate more data. By morning, you're ahead of where you were yesterday while competitors starting today have to catch up to where you'll be tomorrow.

This matters because patents and brand names feel safe but crumble when open source models can copy features in weeks. The moats that matter grow quietly inside your product through data no one else has, integrations too painful to remove, and learning that compounds daily. Series B changes the game because seed investors bet on vision and Series A investors want proof it works, but Series B investors need to believe you'll dominate the market. That's when invisible moats become your story.

Why Series B investors overlook them

Think about how investors evaluate companies. They sit in conference rooms studying charts where revenue curves and user growth jump out while the subtle advantages hide in technical details they'll never see. This creates a fundamental disconnect between what they measure and what actually drives success.

The AI frenzy makes this blindness worse. After hundreds of pitches claiming revolutionary breakthroughs, investors retreat to safe harbors by comparing you to traditional SaaS benchmarks, even though 87% believe AI is necessary for competitive advantage. They benchmark against old valuation models while top-performing companies are 3x more likely to report significantly increased productivity from AI. When markets feel frothy, counting what's countable feels responsible, but it misses what matters.

This shows up clearly in due diligence. Checklists probe the wrong places by verifying security protocols and calculating churn rates while missing the feedback loops making your product smarter every day. They track monthly recurring revenue while ignoring that error rates drop consistently quarter over quarter. They count new logos without noticing that customer acceptance of your AI's suggestions keeps climbing. The gap between what creates value and what gets measured keeps growing, and if you don't bridge it, your biggest advantages stay invisible.

The five categories of invisible AI moats

We've studied dozens of AI companies that built lasting advantages and found the same five patterns appearing repeatedly. Most founders have at least one without realizing it, but the magic happens when you recognize these patterns, strengthen them intentionally, and explain them clearly to investors. Understanding each category helps you identify which defensive positions your startup already possesses and which ones you could develop further.

Proprietary data flywheel

Every customer interaction teaches your model something new. We're talking about specific patterns from how real people use your product, not generic training data anyone can download. When a customer corrects a prediction, your model learns and the next customer gets a better experience. This creates a self-reinforcing cycle where better predictions drive more usage, which generates more data, which improves predictions further.

Watch for climbing suggestion acceptance rates and track prediction errors falling month over month. These signals prove your flywheel spins and accelerates. Companies that embed learning loops everywhere build advantages competitors can't buy or copy because they lack your unique data history. Early AI adoption creates these permanent head starts that compound over time.

Workflow integration

Some AI tools sit on top of workflows like decorations. Others weave so deeply into daily operations that removing them would break everything. The difference lies in how thoroughly your AI connects to existing systems through custom API integrations built over months, data pipelines flowing between systems, and automations that streamline workflows across the communication apps teams already use.

You'll know you have this moat when retention hits 95% and stays there, when customers use your features hourly rather than monthly, and when switching would mean rebuilding their entire process. This depth of integration creates switching costs that go beyond inconvenience to operational impossibility. Integration depth beats feature count every time because features can be copied but deeply embedded workflows cannot.

Contextual intelligence

Generic AI gives generic answers. But systems that understand why someone asks a question deliver magic by knowing a sales email needs different tone than a support ticket, remembering past interactions, and recognizing patterns specific to each business. This contextual awareness transforms good features into irreplaceable ones.

The intelligence grows richer with time as your system learns the nuances of each customer's business. Six months after launch, it handles edge cases that would confuse any competitor. A year later, it anticipates needs before users ask. Context turns a commodity AI into a custom-built solution that feels like it was designed specifically for each customer, making alternatives feel clumsy by comparison.

Human-in-the-loop feedback

AI-native companies know models need constant refinement, so they build tight loops between AI output and human judgment. When the customer success team spots an edge case, engineers fix it within days. When patterns emerge across customers, updates roll out to everyone. This rapid iteration comes from culture, not code.

Teams that treat every mistake as a learning opportunity pull ahead of those waiting for quarterly updates because the compound effect of daily improvements creates distance competitors can't close. While others debate feature roadmaps, these teams ship improvements based on real user feedback. The result is AI that gets noticeably better every week, creating user experiences that feel almost telepathic in their accuracy.

Networked learning effects

Most products get better for you when you use them more. Network effects make products better for everyone when anyone uses them more. The magic happens when one customer encounters a new scenario and your system learns the solution, then every other customer benefits immediately without any action on their part.

Track this by measuring cross-customer insight reuse and counting how many improvements discovered with one customer help others. Time how fast enhancements spread across your base. When individual experiences improve collective intelligence, you've built something special that gets stronger with every new customer. Unlike traditional network effects that require users to interact, AI network effects work silently in the background, making every customer a contributor to the product's intelligence.

These five categories explain why boring technical details matter more than flashy demos. Now let's translate them into language investors understand.

Turning moats into metrics investors love

Investors speak numbers, so show them curves going up and to the right, but pick the right curves. The metrics that matter reveal compound advantages growing stronger over time, not just current performance.

Start with your data flywheel by graphing prediction error cost per customer quarterly. Divide total model errors by active customers and watch that line drop as your dataset grows. Companies with strong data flywheels see this metric improve dramatically over time, proving the moat gets deeper with scale.

Workflow integration shows up in logo retention, specifically aiming for 95% minimum paired with Net Revenue Retention above 120%, the benchmark Series B investors expect from enterprise SaaS. When companies expand usage instead of churning, you've proved stickiness that goes beyond satisfaction to operational necessity.

For AI economics, create an efficiency score separate from gross margin by calculating revenue minus inference costs, divided by revenue. Show how each model release improves this ratio and graph inference cost per thousand API calls monthly. Falling costs at rising scale prove your economics work and improve over time.

Finally, link customer value improvements directly to AI releases. When LTV/CAC jumps after each model update, investors see the compound effect in action. Build these metrics into a dashboard that updates live, letting numbers tell the story your words can't capture. The key is showing acceleration, not just performance.

Crafting the narrative: clarity, authenticity, differentiation

You get one shot at the Series B story. Three elements make it stick.

Clarity means anyone can repeat your moat in one sentence. The best pitches frame their advantage simply: focusing on unique data access, irreplaceable workflow position, or compound learning effects. They spend their entire deck proving that single claim. Every chart supports it. Every metric reinforces it. By the end, investors can't forget it.

Authenticity means showing only what exists today. Bland AI raised $65 million by running live demos during pitch meetings. Investors watched their AI handle real customer calls while retention dashboards updated on screen. No mockups. No projections. Just proof.

Differentiation means explaining why the gap widens daily. Maybe you retrain models in hours while competitors take weeks. Maybe you access customer data others can't touch. Connect that edge to specific wins. Show how Customer X saved millions because only your system could solve their problem.

Before each meeting, run through this checklist: Can someone explain your moat without jargon? Does every slide include proof? Do graphs show you pulling away from the pack? Would two founders describe it identically? These questions reveal whether your story holds together under pressure.

Common mistakes kill good stories. When founders contradict each other about the technology, investors lose confidence. Technical explanations that lose the audience waste precious time. Tired phrases recycled from seed decks signal lazy thinking. Fix these basics and investors stop seeing another AI pitch. They start seeing a company built to dominate.

Common misconceptions and pitfalls

Every Series B discussion includes dangerous myths that derail good companies. Understanding these traps helps you address them head-on rather than letting them undermine your pitch.

"Patents protect AI companies" sounds logical until you realize open source moves faster than patent lawyers, and by the time you get protection, the world has moved on. Similarly, "more parameters mean better moats" misses the point entirely. A small model that understands context beats a large model spitting generic responses because size might impress engineers, but it doesn't impress customers who care about results.

Growth expectations create another trap. "AI companies should grow like SaaS" ignores fundamental differences in how these businesses scale. The curves look different because AI improvement is exponential, not linear. This connects to the compute cost concern where "high compute costs signal problems" becomes a red flag for traditional investors. In reality, smart GPU spending builds moats that strengthen over time.

Finally, "the AI bubble means everything's overvalued" reflects old thinking. Standard multiples can't price exponential advantages, especially when 66% expect at least 3x productivity gains from AI within five years. Traditional valuations miss the point because they measure current performance rather than compound potential. Know these traps before walking into the room so you can address concerns before they become objections.

Action plan: surface your AI edge before the raise

Three months before fundraising, start building proof. This timeline gives you space to gather compelling data, refine your story, and practice until your pitch becomes undeniable.

Begin by mapping your moat signals throughout your product. Follow data flows to identify where feedback loops compound and AI hooks deepest into workflows. These spots represent your defensive positions that competitors can't easily attack. Once mapped, quantify everything by setting up tracking for retention, inference costs, error rates, and acceptance rates. Watch these metrics weekly since investors trust trends more than snapshots, and consistent improvement tells a powerful story.

Your messaging needs equal attention. Write your one-sentence moat and test it on friends outside tech. If they can't repeat it back, keep simplifying until the concept clicks instantly. Then build proof into every slide by ensuring claims have evidence, promises have metrics, and stories have data. This preparation leads to the final step: practicing with brutal honesty, where your team challenges every assertion and questions every metric, finding holes before investors do.

Document these learnings in a shared doc that you update after each practice session. Watch your story sharpen as weak points get stronger and strong points get clearer. Start this process now rather than waiting for next month or some arbitrary milestone, because the companies that win Series B prepare while others chase growth metrics.

The AI competitive advantage investors need to see

We've watched too many strong AI companies fail at Series B because they couldn't explain their invisible moats. They had the technology, the customers, and the growth, but they lacked the story that connected all three into a compelling vision of market dominance.

Your invisible moats already exist and grow stronger every day. Data compounds in your servers while AI weaves through customer workflows. Context deepens with every interaction as teams learn from every error. Networks spread improvements instantly across your entire customer base. These advantages grow stronger daily, but only if investors understand them well enough to bet on your future.

The path forward is clear: map each moat to metrics investors track, tell stories they'll remember, and show proof they can't ignore. Do this right, and the conversation shifts from defending your valuation to picking the right partner who understands your true competitive advantage.

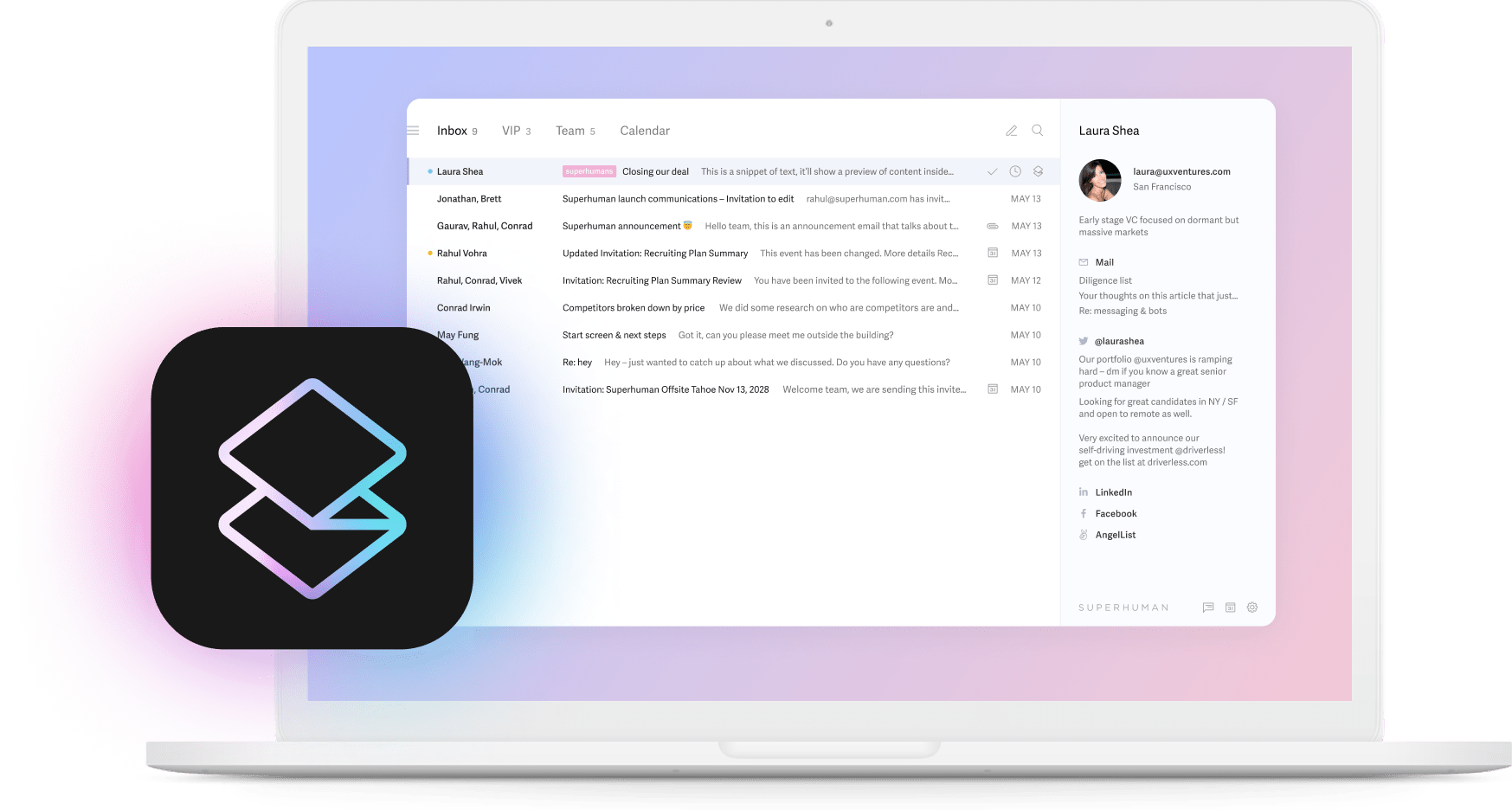

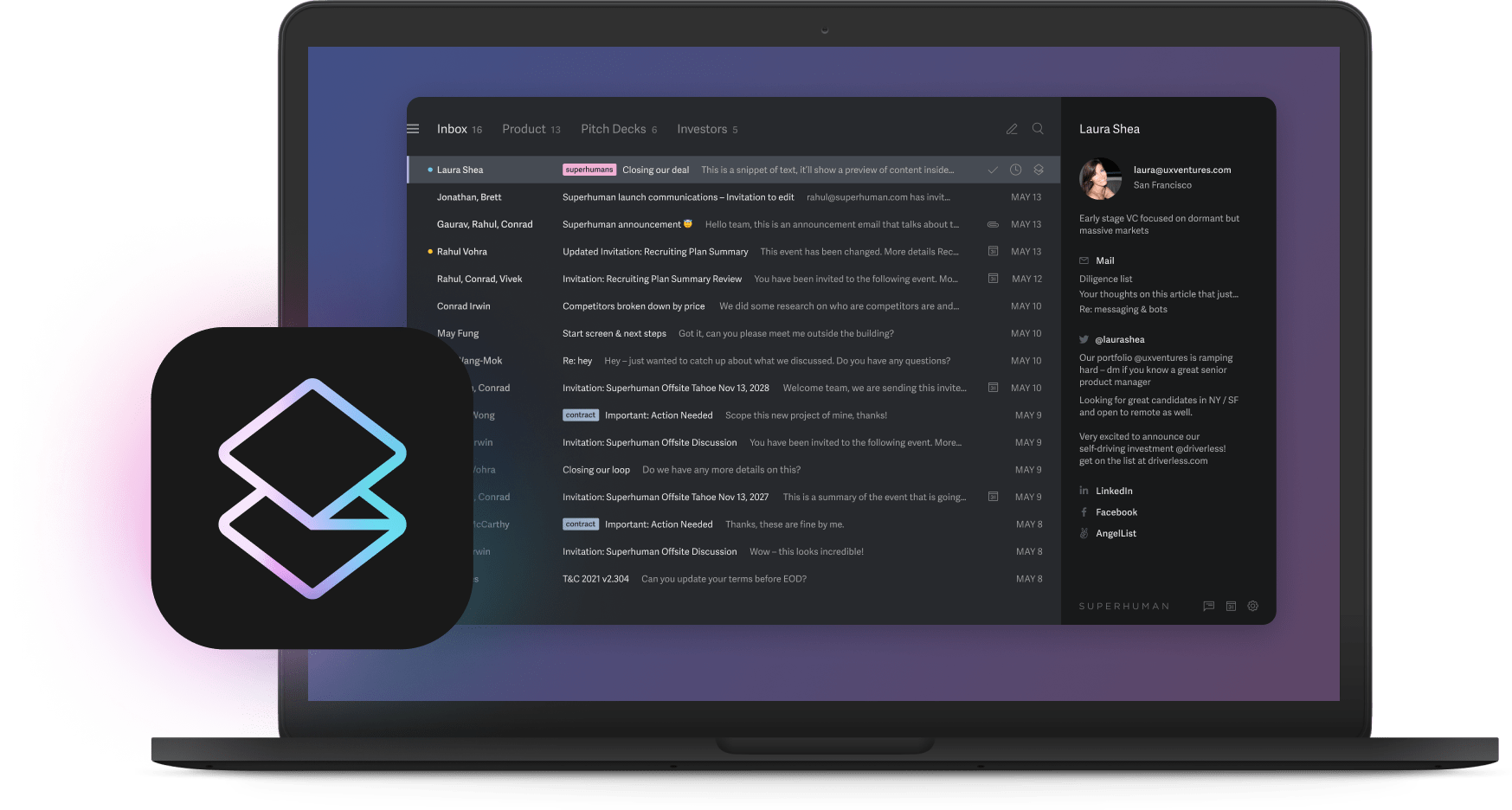

For teams building these advantages today, look at how Superhuman approaches email. By learning from every message you write and matching your tone for each recipient, Superhuman helps users send 72% more emails per hour while saving 4 hours every week. That's an invisible moat in action where deep workflow integration plus continuous learning equals competitive advantage no feature list can match.

The best time to build invisible moats was when you started. The second-best time is now.