AI isn't a side project anymore. Revenue per employee in AI-exposed sectors grows faster than everywhere else, yet the biggest acquisition premiums don't go to companies that automate everything.

Buyers actually prefer firms in the "Goldilocks Zone," where 40 to 60 percent of work is automated, leaving clear room for improvement after they acquire you.

Why does this sweet spot matter so much? Acquirers want to push margins higher after they close the deal. Automate too little and you look inefficient. Automate too much and you've already captured the cost savings they wanted to claim.

This playbook shows you how to hit that balance perfectly and discover which metrics predict the best multiples. Maximum automation might sound impressive, but smart, measurable efficiency is what gets you the best offers.

Executive cheat sheet: the Goldilocks zone (40-60% automation)

Think about how transformative technologies reshape company valuations. Today, AI does the same for deal multiples, but only when automation hits the sweet spot between 40 and 60 percent of your workflows.

At that level, you prove AI-native efficiency while still giving buyers clear headroom to extract fresh synergies after the deal closes.

Map your workflows in Lucidchart or Miro, count total steps across the customer journey, flag automated steps in green and manual in red, then divide green by total. When this calculation lands between 40 and 60 percent, you've hit the target.

Go much higher and you risk stripping out the very value acquirers want to capture. Stay lower and you look behind the curve.

Companies in this automation band often command stronger acquisition premiums than heavily automated peers. This middle ground signals efficiency without closing the door on future upside.

Productivity gains show up in headline metrics like revenue per employee, yet they're not fully harvested. Premiums peak here because buyers can still create value through further AI rollouts.

Push automation too high and regulatory, cultural, and integration risks can start to outweigh savings. Stay too low and you may appear less competitive.

Understanding this balance proves crucial because buyers pay for tomorrow's savings, not yesterday's achievements. When automation levels hit the sweet spot, acquirers see both proven efficiency and clear paths to additional value creation.

The 80% productivity trap: how over-automation kills your exit

Picture a lean SaaS team that automated 85 percent of its workflows. Revenue per employee topped impressive levels, mirroring efficiency extremes seen in AI-first startups. Investors loved the headline number, yet serious bidders often walk during diligence.

Why? There's no room left for synergy. Every cost the acquirer hoped to remove already disappeared.

Excess automation creates multiple problems beyond killing synergy opportunities. Legal teams grow uneasy when core decisions depend on black-box models that outsiders cannot audit. Opaque AI in compliance or risk management can trigger regulatory delays and extended reviews.

Culture adds another layer of risk. Over-automated firms may face talent flight during acquisition negotiations as key employees question their future roles. When everything runs on algorithms, human expertise becomes undervalued and top performers start looking elsewhere.

Even impressive productivity statistics can backfire. While revenue per employee in AI-exposed sectors grows rapidly, that same acceleration triggers wage pressure and retention risk, tempering bidder enthusiasm. Acquirers worry about maintaining these efficiency levels without the original team.

The solution stays simple: aim for "efficient enough."

Automate roughly half of each critical workflow, keep expert humans in the loop, and document the manual steps you deliberately leave behind. That balance proves your model works today while gifting acquirers clear, quantifiable upside tomorrow.

Metric makeover: KPIs that actually predict strong multiples

Traditional metrics tell only half the story when AI transforms your business model. While revenue per employee remains valuable, buyers now focus on three advanced indicators that better predict acquisition premiums.

AI-driven net revenue retention (NRR) uplift measures how automation helps you expand revenue from existing customers.

Tag every upsell in Salesforce or HubSpot with 'AI-driven' or 'manual.' Run monthly cohort analysis comparing 12-month retention rates between tagged groups.

Calculate by comparing your current total revenue against the previous period, subtract all revenue churn from canceled subscriptions, then isolate the portion attributable to AI-powered upsells or retention wins.

Target 5-10% higher retention for AI-touched accounts. Companies showcasing this clear attribution often enjoy better acquisition offers.

TAM expansion percentage attributable to AI features shows how intelligent systems unlock new market opportunities.

List your pre-AI serviceable addressable market (SAM) in a spreadsheet. Add new customer segments or use cases enabled by AI features. Divide new revenue from AI-enabled segments by original SAM. Update quarterly using win/loss data from your CRM.

This metric resonates particularly well with strategic buyers seeking platforms that expand into adjacent markets.

Customer-success AI leverage ratio counts support tickets resolved per customer service employee after AI implementation.

Pull monthly ticket volumes from Zendesk or Intercom, divide by FTE support headcount, then compare pre-AI baseline to current performance.

Track both auto-resolved tickets and agent-assisted resolutions separately. Aim for 2-3x improvement in tickets per agent while maintaining CSAT scores above 85%.

Smart routing, automated responses, and predictive issue resolution drive these gains.

Focus particularly on predictive customer lifetime value (pCLV) and churn prediction accuracy. These forward-looking indicators help buyers model post-acquisition performance, turning due diligence from a risk assessment into a growth demonstration.

Companies that demonstrate clear AI-driven improvements in these areas consistently attract premium offers.

Bidding-war case studies vs. buyer-flight scenarios

Picture two boardrooms on the same Tuesday morning.

In one, bankers compete to pitch an AI-native collaboration platform that automates about half its support workflows while still relying on human account teams for complex issues.

In the other, a similar SaaS firm flaunts 90 percent automation with only a skeleton crew.

The first company sparks a bidding war. The second struggles to keep one bidder in the data room.

What separates winners from write-downs is balance.

The successful platform automated enough repetitive tickets to demonstrate healthy revenue per employee and potential for future cost-reduction opportunities. This sweet spot attracts multiple bidders and accelerates closing timelines because integration risk feels manageable.

The key insight: automate enough to prove efficiency, then document where buyers can squeeze the next 20 percent.

Over-automation creates real problems. When support automation reaches extreme levels with most customer success running on black-box models, strategic buyers often exit negotiations. Remaining bidders typically reprice offers with significant discounts, citing integration and cultural concerns.

The pattern repeats across industries: companies maintaining explainable AI systems with human oversight consistently outperform hyper-automated peers in acquisition processes.

Winning patterns emerge clearly. Buyers pay premiums when automation is:

- Transparent

- Reversible

- Leaves room for future gains

They retreat when systems are:

- Opaque

- Culturally brittle

- Already optimized to exhaustion

Document your automation choices carefully and maintain clear upgrade paths for potential acquirers.

Strategic inefficiency: why leaving some tasks manual adds millions

Automating everything sounds smart until you realize buyers pay less for companies with no room left to improve. Strategic inefficiency, deliberately keeping certain workflows manual, has become a sophisticated exit strategy that regularly adds millions to acquisition prices.

This approach works because buyers fundamentally purchase future value, not past achievements. When you've automated every possible task, that upside evaporates and premiums shrink accordingly. The most successful targets maintain roughly 40 percent of workflows in manual or semi-manual states, creating clear synergy opportunities for acquirers.

Some functions actually deteriorate under full automation. Legal compliance, risk management, and complex customer support require human judgment that algorithms cannot replicate reliably.

Keeping humans in critical loops reassures buyers that your company can adapt to new regulations without systemic failures.

Here's the decision framework for what to automate. Create a 2x2 matrix with "volume" on one axis and "risk" on the other. High-volume, low-risk tasks like data cleansing, email categorization, and invoice matching should be fully automated. High-risk tasks including compliance approvals, refunds over $1,000, and contract modifications need human checkpoints. Revenue-driving features work best with AI generating recommendations that humans approve in tools like Salesforce or your admin panel.

Document these choices strategically for potential buyers. Create a Notion database listing every manual touchpoint with columns for process name, steps involved, hourly cost (annual salary divided by 2,080 hours), and monthly volume. Calculate annual spend per process by multiplying hourly cost by time spent by volume. Add a column showing projected savings from automation. Export this as a value creation roadmap that shows buyers exactly where they'll save money post-acquisition. This transforms apparent "inefficiency" into a compelling value proposition justifying premium pricing. Smart companies use AI throughout operations while maintaining human planners for exceptions and complex decisions.

This hybrid approach protects margins while attracting acquisition partners who see millions in obvious post-deal optimization opportunities.

PE vs. strategic buyers: two lenses on AI productivity

Private equity and strategic acquirers both seek AI-driven productivity gains, but they evaluate and price these improvements through completely different frameworks. Understanding their distinct perspectives helps you position your automation story at the optimal level.

Private equity firms operate with straightforward logic. They model three-to-seven-year exits and prioritize clear cost savings they can capture and scale. PE teams appreciate AI workflows that already boost EBITDA while leaving room for additional optimization once integrated into portfolio roll-ups. When software companies maintain moderate automation levels, private equity buyers can visualize clear paths to margin expansion.

Strategic buyers look beyond immediate cost reduction toward long-term competitive advantages. They value proprietary datasets, defensible algorithms, and integration speed with existing product ecosystems. A moderately automated business that also owns unique data assets or recommendation engines aligned with an acquirer's roadmap can trigger intense bidding wars, as strategic buyers view these capabilities as growth engines rather than mere cost-cutting tools.

Use this framework when crafting your acquisition pitch. For private equity audiences, build a simple Excel model showing current EBITDA margins and potential improvement from automating the remaining 40% of workflows. Include specific cost savings by department and timeline to capture. When targeting strategic buyers, create a one-page visual showing how your data assets complement theirs, map API integration points, and highlight shared customers from Salesforce data. Show cultural alignment through employee retention rates and glassdoor scores above 4.0. The constraint typically isn't technological capability but organizational readiness and change management, making transparent benefits more valuable during diligence.

Engineering isn't everything: why customer-facing AI wins valuation points

Buyers scrutinize product roadmaps for AI that directly impacts customers, not just internal development velocity. When algorithms reduce support response times, deliver personalized recommendations, or streamline checkout processes, acquirers can immediately integrate these customer benefits into their own revenue engines.

Customer-facing AI generates the retention and growth metrics that acquirers prize most highly. Predictive churn models and intelligent routing systems boost net revenue retention while maintaining flat headcount growth.

Teams deploying these customer-centric tools report:

- Improved churn prediction accuracy

- Faster response times

- Higher retention rates flowing directly into discounted cash flow valuations

The measurable valuation impact is significant. Software, fintech, and ecommerce companies with live, customer-facing AI features often command premiums above sector medians. The productivity story becomes even more compelling when AI investments focus on external features that directly improve customer experiences.

The strategic takeaway remains clear:

Maintain your development automation tools, but ensure at least half your AI investment reaches customer touchpoints. These visible wins:

- Reassure internal teams

- Delight users

- Provide acquirers with growth levers they can quantify from day one

Customer-visible AI proves safer investment for acquirers compared to deep infrastructure automation that may face adoption challenges.

Designing reversible and complementary AI moats

Build AI systems that buyers can integrate or replace easily, and you'll attract more bidders at higher premiums. Many post-merger integrations fail to achieve targeted synergies, with rigid technology stacks being a significant contributing factor. Companies with adaptable AI often receive more favorable valuations. The lesson: design for flexibility from the beginning.

Buyers conduct thorough technical diligence across several key areas. Data portability ensures information lives in open, transferable formats. Acquirers need confidence they can migrate datasets into existing systems without extensive re-mapping projects that delay synergy realization.

Modular model architecture keeps machine learning components in self-contained services rather than hard-wired into core product logic. Deploy each model in Docker containers on Kubernetes or AWS ECS. Use Terraform for infrastructure-as-code so buyers can replicate environments.

Containerized deployments enable buyers to retire, retrain, or replace individual models without rewriting entire technology stacks. Test model swaps monthly - a clean architecture allows replacement in under 4 hours. API abstraction layers expose predictions through well-documented interfaces. Document every endpoint in Swagger or Postman, including request/response schemas, rate limits, and example calls. Version your APIs using semantic versioning (v1.2.3).

Clean APIs transform your AI capabilities into plug-and-play assets that both strategic and private equity buyers can scale across portfolio companies within weeks of closing.

Human-override controls provide workflow checkpoints where people can review, modify, or reverse automated decisions. Implement approval queues in your workflow tool (Monday.com, Asana) for any automated decision above defined thresholds: customer credits over $500, bulk emails to 1,000+ recipients, or risk scores in the top 10%. Log every override with reason codes in your database. This architecture reduces regulatory risk and builds buyer confidence. Living documentation maintains current notebooks, data lineage maps, and model cards. Use MLflow or Weights & Biases to track model versions, training data, and performance metrics. Create README files for each model explaining inputs, outputs, and business logic in plain English.

Update documentation in the same sprint as code changes. Given faster skill turnover in AI roles, buyers require clear operational playbooks that new teams can follow immediately.

This modular approach protects against integration challenges from inflexible automation architectures. Organizations that package AI as serviceable layers enable buyers to unlock synergies immediately rather than facing months-long integration projects. Before entering data rooms, audit each architectural element and prepare evidence packages including system diagrams, rollback procedures, and integration guides.

Red flags you've over-optimized: the deal-killer scorecard

Run this diagnostic before diligence begins. Schedule monthly reviews with your CFO, CTO, and Head of Customer Success. Score each red flag on a 0-2 scale in a simple spreadsheet. Track trend lines and assign action items for any score above 1.

Each red flag erodes buyer confidence and reduces acquisition multiples:

Extremely high revenue per employee can indicate operational efficiency but may also suggest minimal room for post-acquisition improvements. Solution: Add strategic hires in customer success or sales development to create visible improvement opportunities.

Fully automated compliance and risk processes trigger regulatory concerns when algorithms handle every critical decision without human oversight. Solution: Implement human review requirements for high-risk exceptions and edge cases.

Black-box AI models make it impossible for buyers to assess ongoing risks or integration complexity. Solution: Document model logic and surface key feature weights in accessible terms for non-technical stakeholders.

Critical workflows without human override capability create single points of failure that concern acquirers. Solution: Build approval thresholds requiring human sign-off for high-impact decisions.

Single-vendor dependency on closed platforms inflates integration costs and creates switching risks that buyers must price into offers. Solution: Develop API abstraction layers and data export capabilities that demonstrate platform portability.

Score one point per red flag present:

- 0-1: Deal readiness

- 2-3: Requires tuning before market

- 4-5: Buyers will likely withdraw

When systems appear brittle or opaque, acquirer confidence evaporates quickly during due diligence.

The AI productivity exit playbook

Success requires hitting the 40 to 60 percent automation sweet spot, demonstrating AI-driven growth, and preserving optimization upside for buyers. Use this framework during your final pre-market year to maximize acquisition value.

Value-adding strategies

Maintain overall automation between 40 and 60 percent of total workflows to capture strong multiples while preserving buyer synergy opportunities.

Track metrics that matter to acquirers:

- Net revenue retention uplift from AI features

- Total addressable market expansion through intelligent capabilities

- Customer success efficiency ratios

Document your modular, API-based architecture to demonstrate integration flexibility and reduce buyer technical risk.

Keep humans involved in compliance oversight and model governance to smooth regulatory diligence and prove operational resilience. This hybrid approach consistently outperforms pure automation strategies in acquisition processes.

Value-destroying mistakes

Pushing automation so far that it eliminates potential buyer synergies will impact deal value. Never deploy black-box models without explainability documentation, as they slow diligence and invite regulatory scrutiny.

Fully automated risk, compliance, or escalation processes create integration anxiety that reduces buyer confidence and offer amounts.

12-month preparation timeline

Begin with baseline measurement of automation ratios and AI-driven KPIs. Use Google Sheets to track automation percentage across departments, NRR uplift by cohort, and customer success metrics weekly.

Nine months before market: Freeze non-essential automation projects in Jira and redirect engineering resources to features that boost retention. Run A/B tests on AI features to prove impact.

Six months out: Hire a technical writer to document your ML models in plain English and create architecture diagrams in Lucidchart.

Three months before launch: Compile everything into a secure Datasite room with folders for:

- Technical documentation

- Financial impact analysis

- Integration guides

Track three critical numbers monthly in a CEO dashboard. Pull automation percentage from your workflow mapping tool, calculate AI-driven NRR uplift from CRM tags, and measure predictive CLV accuracy by comparing predictions to actual 12-month values.

Set alerts when automation exceeds 65% or NRR uplift drops below 5%. If any metric drifts outside target ranges, reduce automation scope in your next sprint and add human approval steps to maintain acquisition appeal.

The strategic insight remains powerful. Keeping deliberate operational inefficiencies today can add millions to tomorrow's offer by preserving the upside optimization opportunities that justify premium acquisition multiples.

While this M&A playbook focuses on exit strategies, the underlying principle applies broadly: smart automation beats maximum automation.

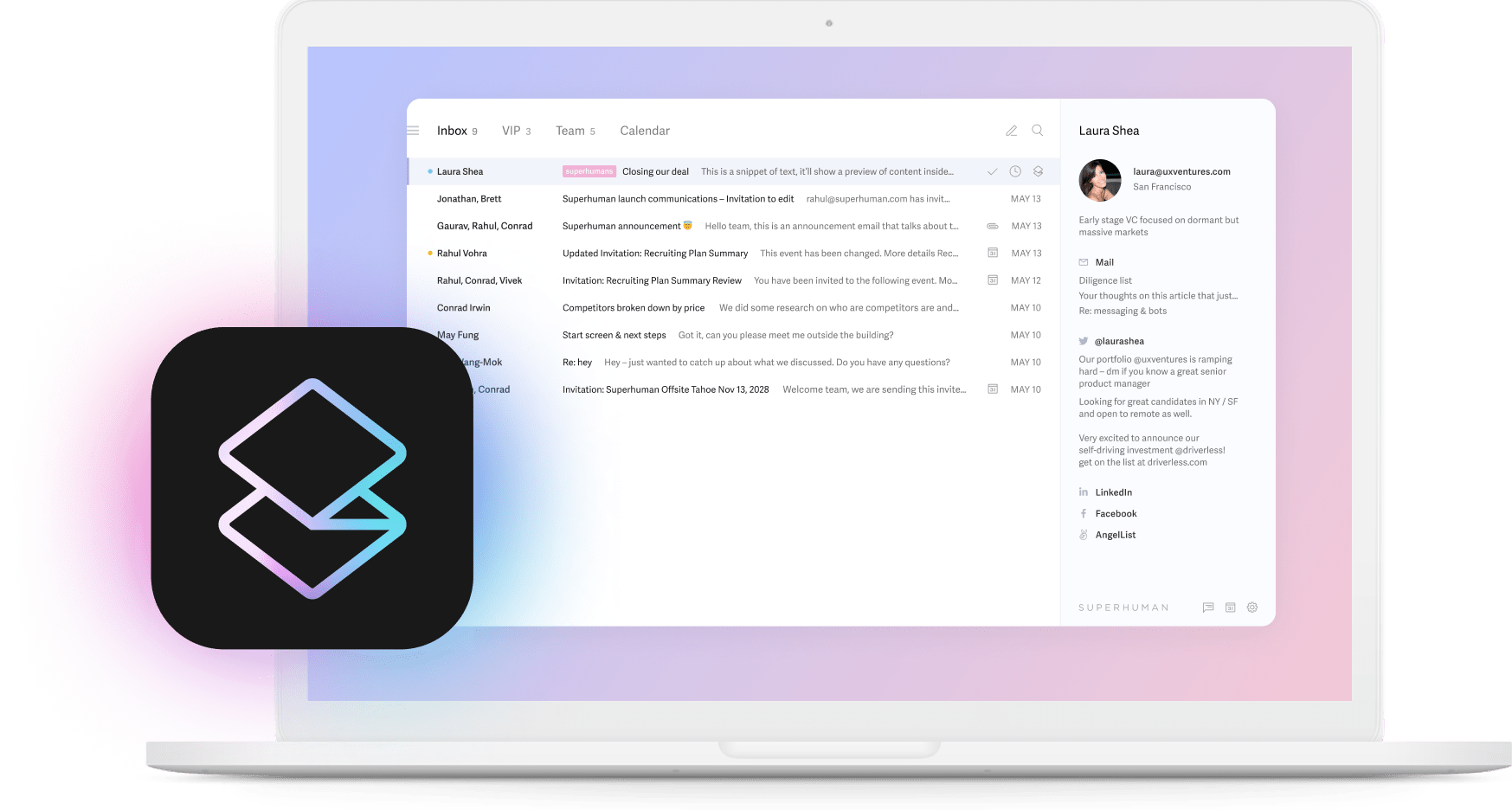

Just as Superhuman helps teams work more efficiently without replacing human judgment, the most valuable companies combine AI capabilities with strategic human oversight to create sustainable competitive advantages.