Two portfolios start with the same million dollars. One gets checked by a traditional advisor quarterly. The other runs on AI that analyzes market data every second. After ten years, the performance gap tells you everything about the future of wealth management.

Smart algorithms process market data continuously, spot patterns in noise, and act the moment odds shift in your favor. Human advisors work business hours, rely on quarterly reports, and avoid bold moves that might hurt their reputation. This constant attention matters when opportunities vanish in seconds and sentiment changes overnight. Algorithms never sleep, never panic, and never let emotions drive decisions.

This breakdown shows you exactly how sophisticated AI finds opportunities human advisors miss. You'll see how it processes raw data, surfaces contrarian plays, harvests volatility, and discovers tax strategies your CPA overlooks. By the end, you'll know where algorithms consistently outperform human judgment and how to use that edge in your own portfolio.

The cost of human advisors

Human advisors charge up to 1% or more in annual fees, which compounds significantly over the years and reduces overall returns. AI-driven portfolios emerge as cost-efficient alternatives since they automate many routine tasks that justify those hefty price tags.

Beyond fees, cognitive biases present a significant hurdle. Career-risk bias leads advisors to avoid unconventional decisions that could potentially harm their reputations or professional standing. These biases often result in missed opportunities, as human advisors shy away from making bold calls even when data supports them. They typically perform portfolio reviews monthly or quarterly, limiting their ability to react to rapid market changes that AI systems capture routinely.

Emotion and overconfidence cloud human judgment as well. Unlike AI systems that process data without emotional interference, human advisors can be swayed by market sentiment or personal biases. This limitation often results in reactive decision-making rather than strategic adjustments based on comprehensive data analysis. While AI technology executes strategies relentlessly and without bias, human advisors focus on relationship management and complex decision-making where their skills add most value.

How real AI mines alpha humans can't

Picture an engine that never sleeps, scanning markets and alternative data to spot opportunities the moment they appear. Real AI in wealth management runs on high-performance computing clusters packed with GPUs and TPUs, not rules-based robo-advisors that rebalance quarterly.

These systems use frameworks like Apache Spark Streaming to digest live data feeds at scale, while TensorFlow handles AI modeling downstream. A messaging layer moves market ticks, earnings transcripts, and social sentiment with millisecond latency. Neural networks hunt for patterns across millions of inputs while large language models summarize unstructured text from regulatory filings and CEO remarks.

Models retrain continuously, staying current with shifting market regimes and reacting instantly when correlations break or new data arrives. The system treats every signal on its statistical merits, free from career-risk bias and emotional noise. You can feed it almost anything: market prices, options flows, credit-card spend, LinkedIn hiring velocity, and satellite traffic counts all stream into the same decision fabric.

Here's how to separate real AI from pretenders. Ask about assets analyzed each day. Does the platform track every global listing or just the S&P 500? Check their retrain cadence. Are models updated continuously or once a year? Determine automation share. What percent of trade decisions run end-to-end without manual overrides? If the answers are "millions," "daily or faster," and "most," you have a true AI partner.

Counter-intuitive wins only algorithms caught

Leave a model running long enough and it starts to notice odd signals that slip past even the best analysts. AI systems crunch millions of data points without ego or fatigue, stitching together patterns that look like noise to the human eye. You see ideas earlier, act faster, and often profit from moves most advisors never spot.

Crypto arbitrage before the herd

Dozens of exchanges quote slightly different prices for the same token. Humans might check a few screens daily, but AI-driven trading engines watch every order book in real time, searching for tiny but reliable spreads. When gaps appear, the system routes simultaneous buy-sell orders within microseconds, booking gains before markets equalize.

By pairing continuous monitoring with real-time decisions, algorithms exploit price inefficiencies lasting only seconds. You never see the window, yet the trade settles and capital redeploys. The result is a steady stream of small wins compounding during volatile crypto sessions.

SPAC pattern recognition

During market booms, deals often surge on whispers days before official announcements. Models trained on news sentiment, options flows, and social chatter flag those names early, ranking probability of near-term gains. Because models have no career-risk bias, they recommend tickers many human advisors dismiss as speculative.

The same models identify when hype peaks, helping you exit before volatility spikes. Algorithms sift alternative data at scales no research team matches, then translate findings into timely, unbiased calls.

Pre-IPO and private-market mispricing

Private markets brim with incomplete information, yet AI thrives on unstructured signals. Systems track LinkedIn hiring velocity, patent filings, and website traffic, scoring every startup in their universe. When unusual upticks appear, like engineering hires doubling quarterly, they flag companies for deeper review.

The same approach works for individual investors accessing late-stage private rounds. Algorithms value companies based on live operating momentum rather than stale quarterly updates, revealing mispricings hidden from spreadsheets. By turning alternative data into actionable insight, AI gives you a head start in markets once reserved for well-connected gatekeepers.

Concentrated bets vs. 60/40: AI's new playbook

Traditional 60/40 portfolios felt safe for decades, but rigid structures leave you exposed when interest rates spike or market dynamics shift. AI systems flip this approach by managing concentration risk instead of avoiding it entirely, capturing upside that broad diversification often dilutes.

Traditional portfolios get reviewed quarterly or annually, so risks build between meetings. AI engines process live market data, options pricing, and alternative datasets continuously, running thousands of Monte Carlo simulations in minutes. These scenarios show exactly how concentrated positions might impact your net worth if volatility doubles overnight. The system then suggests hedges, structured products, or staged selling strategies preserving upside while limiting downside risk.

This addresses what you might call the high-net-worth allocation problem. Strategies built for billion-dollar funds spread money so thinly that portfolios under $50 million barely benefit. AI concentrates capital where risk-adjusted opportunity is strongest, then constantly recalibrates. Real-time rebalancing with personalized risk budgets delivers better risk-adjusted returns than static asset allocation.

Risk management runs parallel to return generation. Value-at-Risk calculations update continuously, alerting you when positions exceed predefined limits. If stress signals appear, the system automatically reduces exposure or adds protective options. These AI risk dashboards operate around the clock, converting abstract tail risks into actionable alerts.

Tax optimization happens automatically too. By tracking every tax lot in real time, AI suggests donating appreciated shares, harvesting offsetting losses, or timing Opportunity Zone investments when market conditions support trades. This continuous optimization transforms concentrated positions from tax burdens into sources of after-tax alpha.

The system executes trades in milliseconds, eliminating behavioral mistakes plaguing manual rebalancing. When markets swing wildly, AI sells winners and reinforces losers within your risk parameters before emotions interfere. You get portfolios making high-conviction bets while feeling as controlled as any balanced fund, except guardrails move as fast as markets themselves.

Volatility is your friend: algorithms that feast on chaos

Turbulent markets feel unnerving, but well-trained algorithms thrive in chaos. AI-based volatility harvesting treats every price swing as raw material, scanning tick-level data and option order books in real time to extract small, repeatable gains across hundreds of trades.

These systems never sleep. Live price feeds stream into machine-learning engines running continuous risk assessment, updating calculations in seconds. Complex event processing lets models simulate thousands of extreme scenarios before the next trade fires.

Human advisors typically default to cash or Treasurys when volatility spikes. That instinct protects reputations but locks in losses and misses rebounds. Algorithms have no career risk. They pivot from equities to volatility-selling strategies, hedge with options, or reenter beaten-down names the moment statistical signals flip, then rebalance again minutes later.

The same models continuously retrain on fresh data, forecasting when market stress brews. Rising cross-asset correlations, spikes in options skew, or negative sentiment in news feeds trigger pre-emptive hedges instead of post-mortem explanations. If volatility persists, the system widens trading bands. If calm returns, it tightens risk budgets, keeping you aligned with long-term objectives without emotional whiplash.

Algorithms don't just survive chaos. They feast on it, turning the very swings that rattle nerves into steady sources of alpha.

The tax-alpha playbook your CPA won't touch

Taxes erode returns daily, yet most people review them annually after damage is done. AI monitors every position continuously, spots tax opportunities instantly, and executes trades while your accountant books appointments.

Here's what it keeps ready: QSBS stacking to multiply capital-gains exemptions, identifying jurisdictions where offshore IP boxes cut effective rates without compliance issues, and precision timing of Opportunity Zone investments maximizing deferral within statutory windows.

The system tracks every tax lot, weighs cost basis and holding periods, then checks wash-sale rules before sending orders. When prices dip, it triggers tax-loss harvesting within minutes and preserves allocation by swapping into correlated assets. Quarterly reviews can't compete with that speed.

AI runs thousands of what-if scenarios before any rebalance, picking paths maintaining target allocation at lowest tax cost. Every move gets logged for auditors, and real-time compliance screens keep everything inside IRS guardrails.

The machines don't replace your CPA. They hand that professional a constantly updated playbook extracting every legal penny of tax alpha from your wealth.

Spotting fake AI: the "robo-advisor in a suit" test

Slick marketing makes any spreadsheet look "AI-native." Before wiring funds, evaluate each platform to separate genuine machine intelligence from branding smoke.

Start by examining their data diet. True AI feeds on more than closing prices. Look for systems ingesting market feeds, alternative signals, and unstructured inputs in real time. Platforms scanning millions of data points every second demonstrate genuine capabilities.

Model transparency matters. If firms can't explain why trades fire, walk away. Deep-learning models are opaque, yet clients deserve plain-English reasoning.

Pay attention to retraining cadence. Markets shift daily, so architectures should support continuous or weekly retraining. Annual updates signal outdated systems.

Fee alignment reveals confidence. Many robo-advisors charge flat AUM fees yet dodge accountability when returns lag. Performance-linked pricing shows real skin in the game.

Explainability tools separate wheat from chaff. Dashboards should translate model outputs into risk, factor, and tax impacts you understand. Anything less erodes trust.

Human oversight remains non-negotiable. Algorithms excel at speed, not context. Platforms embedding review controls and escalation paths reflect proper safeguards.

Watch for AI washing. Ask for concrete evidence like automated decisions per day, live performance audits, and incident reports when evaluating claims.

Run these tests and you'll spot pretenders long before they start trading your capital.

3 game-changing AI platforms to explore now

You don't need billion-dollar tech stacks to put algorithms finding alpha. These three platforms give immediate access to industrial-grade AI, each handling different wealth workflow parts.

- Pipedrive tackles relationship management with AI deal insights keeping every prospect warm without extra clicks. The system spots deals at risk and prompts next steps before you forget. Pipeline heatmaps reveal cash flow bottlenecks developing, while low-code automations push tasks into Slack or calendars. The interface onboards small advisory teams quickly, though portfolio analytics require additional integrations. Think of it as quick wins for client acquisition before handing off to asset-selection engines.

- FactSet delivers data depth through market intelligence platforms pairing real-time feeds with machine-learning screeners surfacing anomalies humans rarely catch. You get global coverage across equities, fixed income, and private markets. ML screeners rank securities against thousands of factors, from ESG sentiment to insider trading trends, while event-driven alerts ping when earnings estimates shift. Enterprise licensing costs less than 1% AUM fees many advisors charge. It's like having quant research desks on call.

- DataRobot enables proprietary signal building without code through end-to-end AutoML, letting you drag-and-drop datasets, then deploy trading or risk models quickly. Automated feature engineering tests thousands of variable combinations while model risk dashboards flag drift and bias before damaging returns. One-click deployment pipelines push predictions straight into trading systems. Rapid experimentation and governance come packaged together, though you'll need clean data upfront. Perfect for firms owning data but lacking data scientists.

All three platforms scale as SaaS subscriptions, not asset percentages. That structure aligns with lower-fee promises while letting you layer human judgment on top. Use these tools automating what machines do best, then spend time on strategic conversations algorithms can't replicate.

Conclusion

AI spots portfolio opportunities human advisors miss. These platforms analyze data continuously, execute trades in milliseconds, and make decisions without emotional bias. They catch mispricing, tax savings, and volatility trades before monthly advisor meetings happen, processing market data, alternative feeds, and behavioral patterns simultaneously.

That doesn't mean firing human advisors. The smartest strategies combine AI speed with experienced judgment. Wealth firms already use algorithms in planning meetings, then let advisors refine recommendations. Start small by routing some assets through automated platforms while keeping trusted advisors available. You'll test technology, learn how it works, and maintain human oversight safety nets.

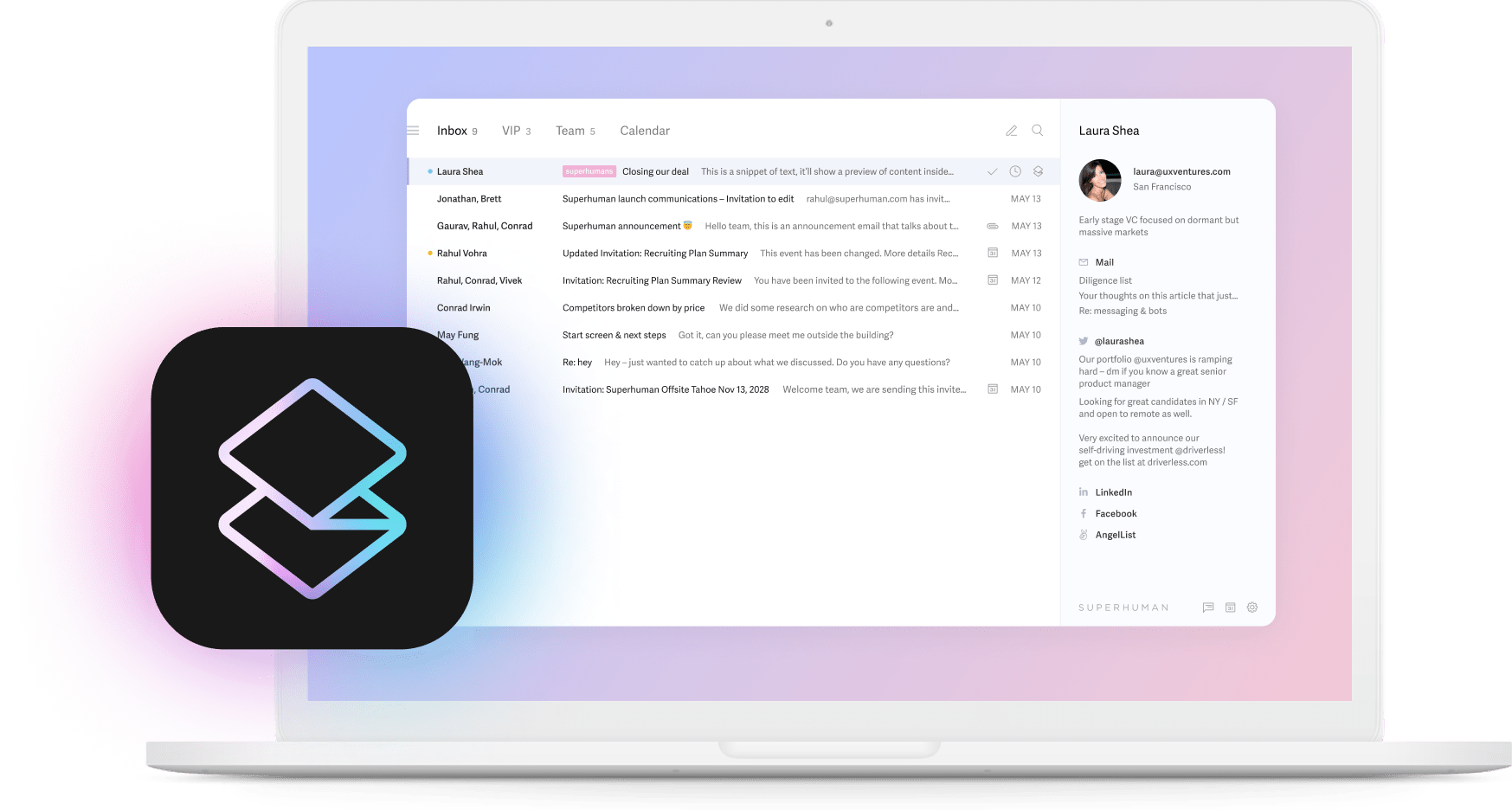

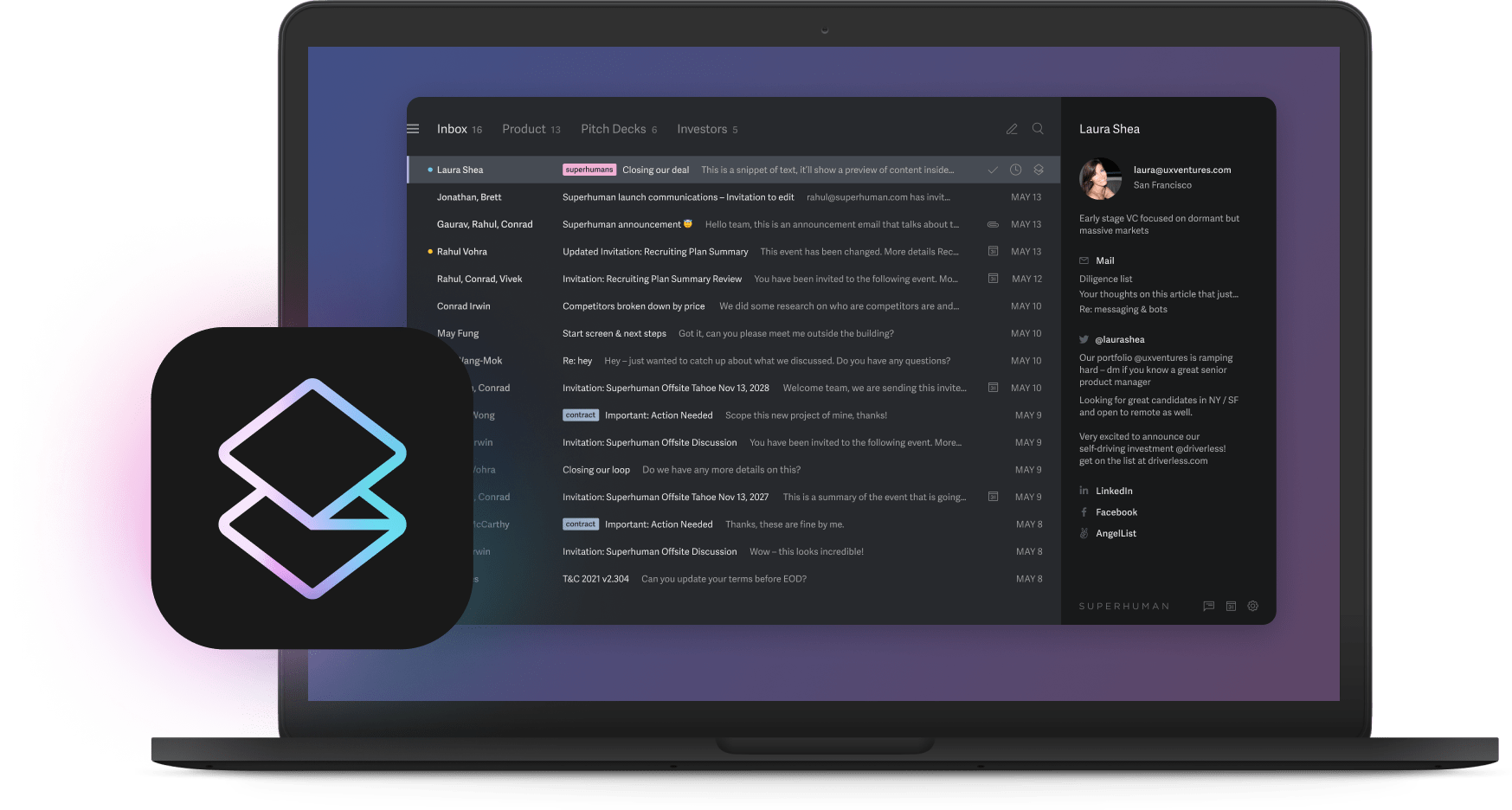

The future belongs to that partnership and the alpha it delivers. While wealth management AI transforms portfolios, similar principles apply across business operations. Just as Superhuman helps teams save hours weekly through AI-powered email management, the most successful strategies combine machine efficiency with human expertise in every domain.