Strategic planning metrics often become the difference between companies that execute successfully and those that drift from one quarter to the next without clear direction. Here's what we've observed across hundreds of organizations: most teams track dozens of numbers that look impressive in presentations but don't actually guide decision-making.

The challenge isn't creating beautiful dashboards or comprehensive measurement systems. The real problem is identifying which specific numbers actually predict success and drive the behaviors that create competitive advantages.

You need metrics that clearly signal when to accelerate, when to adjust course, and when to make fundamental changes. The research proves 5-7 KPIs work best for strategic success. Focus on fewer, more meaningful measurements rather than comprehensive tracking that dilutes attention.

How to pick metrics that matter

Every metric here answers one question: does this number force me to make a decision? If a metric doesn't change your behavior when it moves up or down, it's worthless decoration.

Smart measurement follows six steps that actually work: pick your numbers, set real targets, get clean data, figure out what it means, tell people what to do, keep improving. Simple enough that you'll actually do it.

Want to know if you've picked good metrics? Try this test: can you explain why each number matters in one sentence? If you're using three sentences and mentioning "holistic strategic alignment," you've picked a vanity metric.

Financial metrics that predict the future

Money doesn't lie. These four numbers reveal whether your strategy creates value or just burns cash while everyone pretends things are working.

1. Revenue growth rate

Calculation: (This Period Revenue - Last Period Revenue) / Last Period Revenue × 100

What it reveals about your business: Revenue growth tells you whether customers actually want more of what you're selling. Unlike internal metrics you can massage, revenue reflects real market demand. Think of it as your business report card that customers write.

Growth patterns also predict future headaches. Rapid growth usually breaks your operations. Declining growth kills talent retention because smart people jump ship early.

Strategic decision triggers:

- Growth above 40% yearly: Brace for operational chaos, hire like crazy, expand before competitors wake up

- Growth 15-30%: Focus on efficiency while keeping momentum through smart bets

- Growth 5-15%: Your market position needs work, dig into competitive threats

- Growth below 5%: Time for serious soul-searching about your business model

Real-world strategic implications: Companies losing growth momentum see employee turnover spike 60% higher than industry averages. Top performers smell decline early and bolt for faster-growing opportunities. This creates a talent death spiral that's brutal to escape.

Revenue growth below industry benchmarks hammers your valuation by 30-50% in private markets. That kills your strategic options and makes you prey instead of predator. Sustained growth above 30% yearly forces you to rebuild operations every 18-24 months, but that's a champagne problem.

What gets missed: Most leaders track total growth but ignore where it comes from. Growth from long-term contracts means something totally different than growth from one-time sales. Growth driven by crazy discounts often hides serious customer problems that explode when promotions end.

2. Gross profit margin

Calculation: (Revenue - Cost of Goods Sold) / Revenue × 100

What it reveals about your business: Gross margin exposes whether you have real competitive advantages or just good marketing. This number shows pricing power and how defensible your position actually is. Margins reveal strategic strength before competitors telegraph their moves.

Declining margins often signal competitive pressure or operational problems before these issues show up anywhere else. Expanding margins mean you're getting stronger.

Strategic decision triggers:

- Margins above 70%: Consider premium positioning and aggressive expansion

- Margins 50-70%: Optimize operations while protecting pricing through differentiation

- Margins 30-50%: Evaluate competitive position and find efficiency wins

- Margins below 30%: Urgent strategic review needed, your model might not work

Real-world strategic implications: Organizations with margins below 40% struggle to fund anything strategic. Research, development, competitive responses? Forget it. These companies often become acquisition targets because they can't invest their way out of trouble.

High-margin businesses can invest 3-5x more in customer acquisition and expansion, creating advantages that compound over time. They also survive downturns better by staying profitable when revenue drops.

What gets missed: Many leaders watch overall margin trends without digging into margins by product, customer type, or region. The real insights hide in understanding which specific areas drive margin changes.

3. Cash flow from operations

Calculation: Net Income + Depreciation + Changes in Working Capital

What it reveals about your business: Cash flow from operations shows whether your business actually generates money or just accounting tricks. This separates real businesses from venture-funded fantasies. You can play games with accounting profits, but cash flow reflects actual money generation.

Strong cash flow enables strategic opportunism. Negative cash flow handcuffs every decision.

Strategic decision triggers:

- Positive flow with growth: Go aggressive on expansion and new initiatives

- Positive flow with declining growth: Focus on efficiency and strategic repositioning

- Negative flow with growth: Question whether growth is real or just expensive customer buying

- Negative flow with declining revenue: Emergency operational restructuring time

Real-world strategic implications: Companies generating strong operational cash flow can play offense during downturns, buying competitors when capital gets scarce. They can enter new markets or develop products without begging investors for permission.

Organizations burning operational cash face strategic handcuffs during critical moments. They can't respond quickly to threats or opportunities because every major decision needs external approval.

What gets missed: Most analysis ignores working capital changes that dramatically impact real cash generation. Companies also miss seasonal patterns and timing differences that affect strategic planning.

4. Return on investment (ROI)

Calculation: (Investment Gain - Investment Cost) / Investment Cost × 100

What it reveals about your business: ROI reveals whether your leadership team makes good strategic decisions or just burns money while staying busy. This separates organizations that create value from those that destroy it through poor choices.

ROI patterns show whether leadership has systematic decision-making or relies on gut feelings and luck. Consistent high returns suggest repeatable processes. Random returns indicate random decision-making.

Strategic decision triggers:

- ROI consistently above 25%: Scale successful initiatives and document what works

- ROI 15-25%: Keep current strategies while optimizing execution

- ROI 5-15%: Evaluate decision-making processes and selection criteria

- ROI below 5%: Complete review of strategic planning needed

Real-world strategic implications: Organizations hitting consistent ROI above 20% attract top talent and partnerships because their track record proves strategic competence. They get access to premium opportunities and acquisition targets.

Companies with poor ROI records face increasing scrutiny and often lose autonomy as boards demand oversight of every resource decision.

What gets missed: Most ROI calculations ignore opportunity costs and timing factors. A 15% return in six months means something completely different than the same return over three years.

Customer metrics that predict churn

Customers vote with wallets, not surveys. These five numbers reveal whether customers actually value what you provide or just tolerate it until something better shows up.

5. Net promoter score (NPS)

Calculation: % Promoters (9-10 rating) - % Detractors (0-6 rating)

What it reveals about your business: NPS works as an early warning system for customer satisfaction changes. This predicts customer behavior before it hits revenue, giving you advance notice of problems or opportunities.

Unlike those feel-good satisfaction surveys, NPS identifies customers likely to actively promote or trash your brand through word-of-mouth.

Strategic decision triggers:

- NPS above 50: Invest heavily in referral programs and expansion

- NPS 30-50: Focus on experience optimization and competitive differentiation

- NPS 0-30: Investigate fundamental product or service issues before they become critical

- NPS below 0: Emergency customer experience intervention needed

Real-world strategic implications: Companies with NPS above 50 typically cut customer acquisition costs 20-30% through organic referrals and word-of-mouth. They also command premium pricing because satisfied customers care less about price.

Organizations with negative NPS face increasing acquisition challenges as bad word-of-mouth fights marketing efforts. These companies often see accelerating competitive pressure as unhappy customers actively recommend alternatives.

What gets missed: Many organizations track overall NPS without breaking it down by customer type, product, or interaction channel. The real insights come from understanding which specific segments drive NPS changes.

6. Customer lifetime value (CLV)

Calculation: Average Purchase Value × Purchase Frequency × Customer Lifespan

What it reveals about your business: CLV shows whether your customer acquisition creates long-term value or short-term activity that destroys wealth. This determines whether current marketing investments make sense or just create expensive churn.

CLV trends indicate whether your positioning strengthens or weakens customer relationships over time. Rising CLV suggests strengthening advantages. Declining CLV often signals commoditization.

Strategic decision triggers:

- CLV rising while CAC falls: Go aggressive on expansion and acquisition

- CLV stable with controlled CAC: Optimize experience and expansion programs

- CLV falling while CAC rises: Evaluate fundamental value proposition

- CLV below CAC: Emergency repositioning or stop acquiring customers

Real-world strategic implications: Organizations with high and rising CLV can outspend competitors on acquisition, creating market share advantages that compound. They also attract premium partnerships because partners want access to their customer base.

Companies with declining CLV often become acquisition targets as their customer assets become worth more to competitors who can create better experiences.

What gets missed: Most CLV calculations ignore the fully-loaded costs of serving different customer segments and the varying profitability of expansion opportunities across relationship stages.

7. Customer acquisition cost (CAC)

Calculation: Total Acquisition Expenses / Number of New Customers Acquired

What it reveals about your business: CAC trends reveal market saturation, competitive intensity changes, and marketing effectiveness evolution. Rising CAC often indicates market maturity or increased competition before these changes become obvious elsewhere.

This also exposes whether your growth strategy can scale profitably. Sustainable growth requires CAC that stays stable or decreases as programs mature.

Strategic decision triggers:

- CAC falling with stable quality: Scale acquisition investments aggressively

- CAC stable with improving quality: Keep current strategies while optimizing conversion

- CAC rising with stable quality: Diversify channels and improve conversion

- CAC rising with declining quality: Evaluate market positioning and differentiation

Real-world strategic implications: Companies achieving falling CAC over time often dominate markets by reinvesting savings into further acquisition advantages, creating competitive moats that become impossible to overcome.

Organizations facing rapidly rising CAC typically struggle to maintain growth momentum and often get pressured to pursue less attractive segments or reduce growth targets.

What gets missed: Most CAC calculations ignore fully-loaded acquisition costs, including sales overhead, content marketing investments, and onboarding expenses that significantly impact true economics.

8. Customer retention rate

Calculation: (Period End Customers - New Customers) / Period Start Customers × 100

What it reveals about your business: Retention rate provides the clearest signal of product-market fit strength and competitive positioning effectiveness. High retention means strong value delivery. Declining retention signals fundamental problems needing immediate attention.

This predicts revenue stability and growth potential better than most other indicators because retained customers typically spend more over time while reducing acquisition needs.

Strategic decision triggers:

- Retention above 95%: Focus on customer expansion and premium service development

- Retention 85-95%: Optimize customer success programs and competitive differentiation

- Retention 70-85%: Investigate product-market fit and experience issues

- Retention below 70%: Fundamental strategic review of value proposition needed

Real-world strategic implications: Organizations with retention above 90% typically achieve predictable revenue growth and can invest confidently in long-term initiatives because their customer base provides stable cash flow.

Companies with retention below 80% often struggle with revenue predictability and face continuous pressure to replace churning customers, limiting strategic investment and creating operational stress.

What gets missed: Most retention analysis looks at overall rates without breaking down by acquisition source, customer size, or engagement level. Strategic insights often emerge from understanding which factors drive retention differences.

9. Net revenue retention

Calculation: (Starting Revenue + Expansion Revenue - Churned Revenue) / Starting Revenue × 100

What it reveals about your business: Net revenue retention combines satisfaction measurement with expansion opportunity realization, providing complete insight into customer relationship health and growth potential. This reveals whether customers increase investment in your solutions over time.

Net revenue retention indicates whether your value delivery strengthens competitive positioning and creates switching costs that protect against threats.

Strategic decision triggers:

- Net retention above 120%: Go aggressive on new customer acquisition and market expansion

- Net retention 110-120%: Optimize expansion programs while maintaining acquisition momentum

- Net retention 100-110%: Focus on customer success optimization and expansion opportunity development

- Net retention below 100%: Evaluate fundamental customer value delivery and competitive threats

Real-world strategic implications: Companies achieving net revenue retention above 120% often experience compound growth effects where existing customers fund new customer acquisition through expansion revenue, creating self-reinforcing growth cycles.

Organizations with net revenue retention below 100% face fundamental challenges because customer relationships deteriorate over time, requiring increasingly expensive acquisition efforts to maintain revenue.

What gets missed: 73% of collaborative employees report breakthrough performance improvements when teams invest in communication tools. Customer-facing teams that communicate efficiently respond faster to expansion opportunities and retention risks, directly impacting net revenue retention through superior relationship management.

Market metrics that reveal competitive position

This number shows whether you're winning in the market and maintaining competitive advantages. Market position determines whether strategy actually works in practice.

10. Market share

Calculation: Company Revenue / Total Market Revenue × 100

What it reveals about your business: Market share reveals competitive positioning trends and strategic effectiveness relative to alternatives. Unlike internal metrics you can optimize in isolation, market share reflects real competitive performance against actual alternatives.

This indicates whether strategic initiatives gain ground against competitors or lose market position, providing external validation of strategic choices and execution quality.

Strategic decision triggers:

- Share increasing: Double down on successful strategies and consider market expansion

- Share stable in growing market: Evaluate competitive positioning and differentiation strategies

- Share stable in declining market: Consider market exit or consolidation opportunities

- Share declining: Emergency competitive analysis and strategic repositioning needed

Real-world strategic implications: Market leaders often enjoy pricing power, supplier preference, and talent attraction advantages that create self-reinforcing competitive positions. They also typically achieve better unit economics through scale.

Organizations losing market share frequently face talent retention challenges as top performers prefer winning organizations, creating downward spirals that accelerate competitive disadvantage.

What gets missed: Most market share analysis focuses on revenue share without examining unit share, customer share, or share of specific segments that provide more actionable strategic insights.

Making metrics work in practice

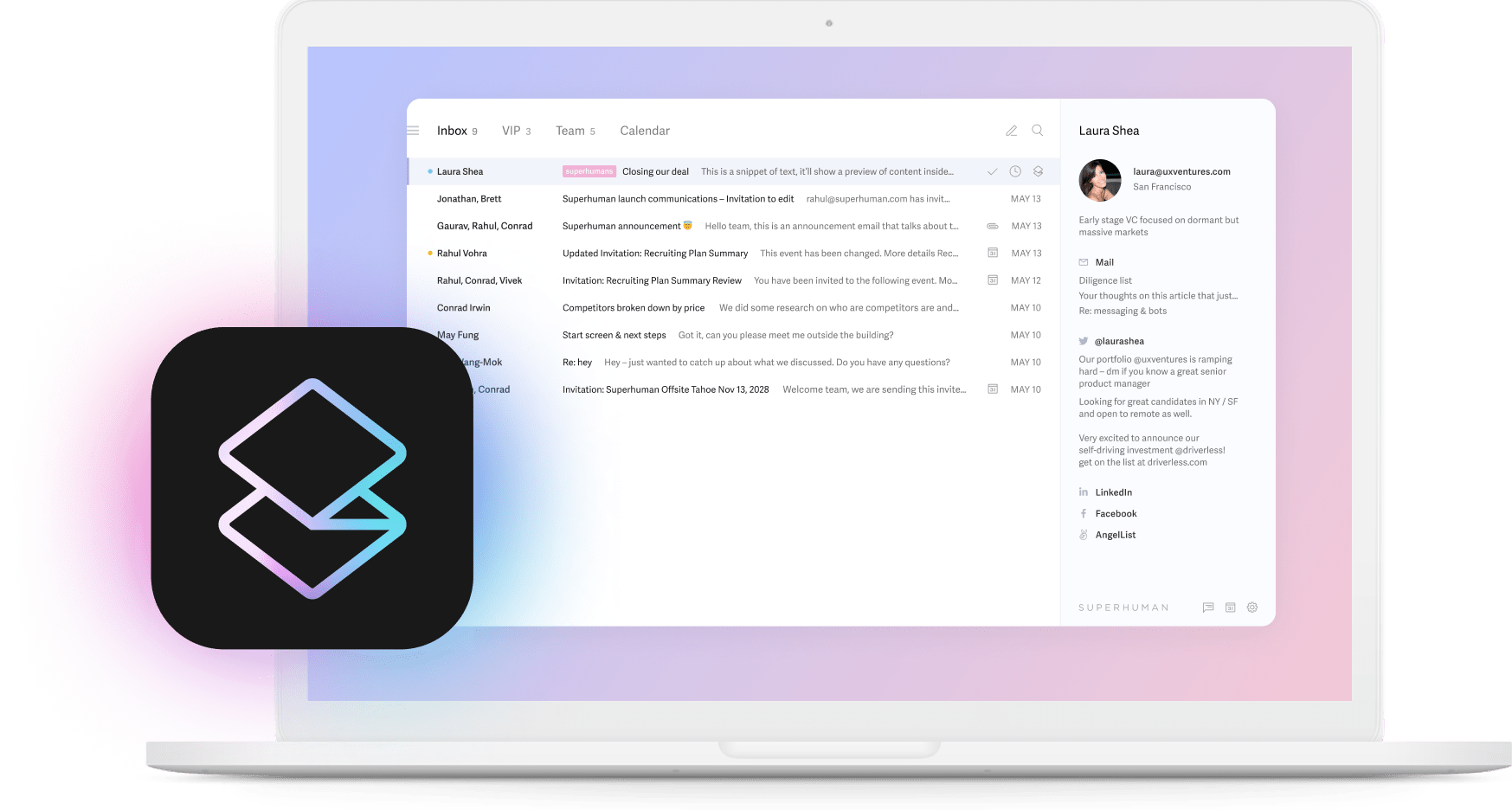

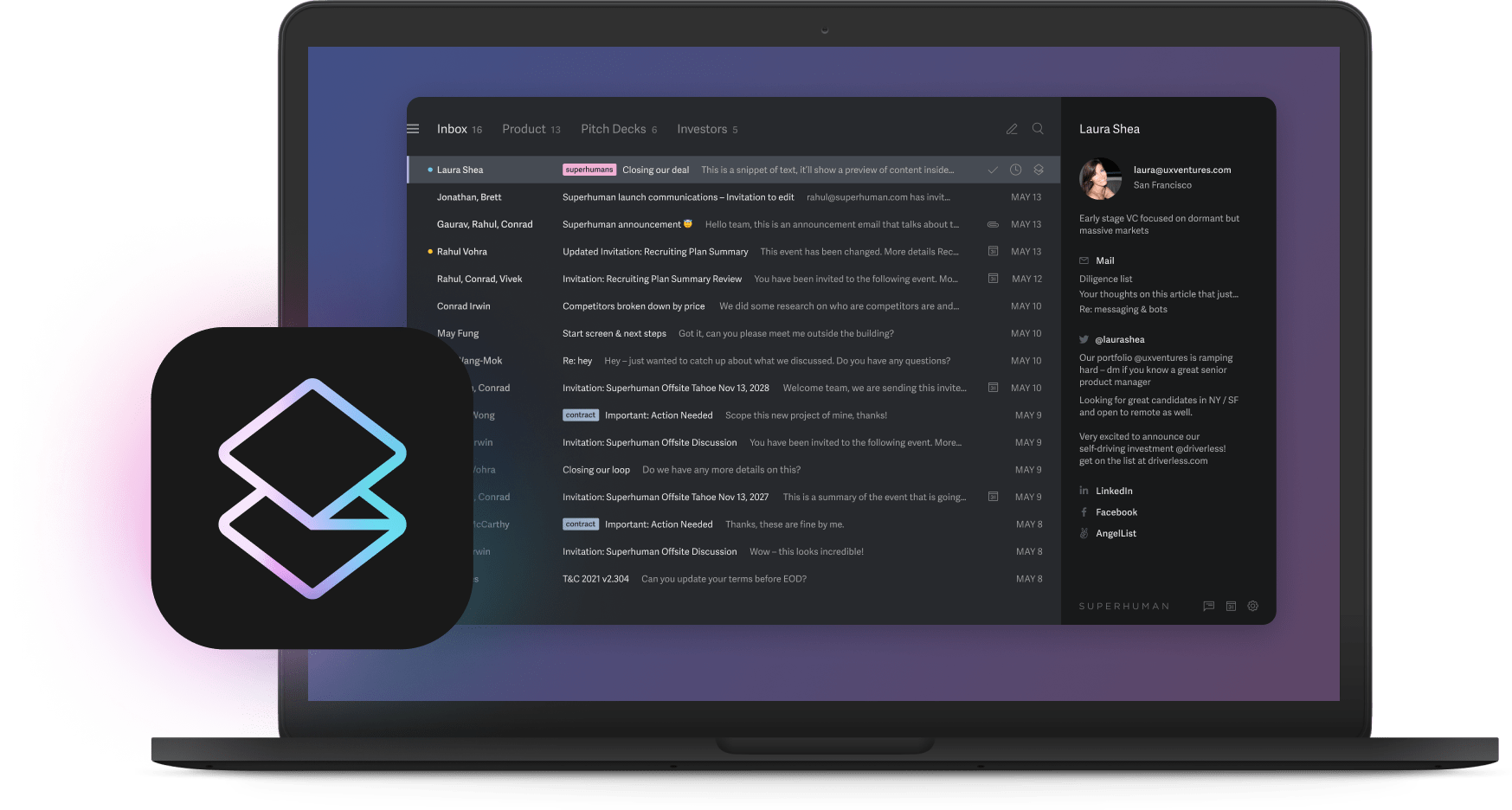

People execute strategy, not spreadsheets. Communication efficiency during strategic initiatives often determines execution success more than planning quality.

Modern organizations need efficient communication systems to maintain coordination and execution speed during strategic initiatives. Professionals using AI support write 59% more business communications per hour than their non-AI-equipped peers, enabling faster coordination and reduced communication overhead that supports organizational effectiveness.

Effective metric selection requires strategic focus and organizational alignment. 3-5 lead KPIs per objective maintain measurement effectiveness without overwhelming organizational capacity. The 10 metrics above provide complete strategic visibility across financial health, customer strength, and competitive positioning without creating dashboard theater that distracts from actual results.