Your bank talks nonstop about AI, yet your inbox remains the real gatekeeper. You're pouring nearly 28% of every workday into email, about 2.6 hours that drain more than 100 workdays each year.

Worse, over half of that communication time delivers little value. When that much time vanishes into triage, you have little left to champion machine learning pilots, oversee compliance models, or iterate on new fraud systems.

The hidden blocker to AI adoption isn't technical complexity. You have no free bandwidth because communication overload hijacks your calendar.

What is AI adoption in banking?

AI adoption in banking refers to the implementation of machine learning algorithms, natural language processing, and automated decision-making systems across financial services operations.

Banks deploy these technologies to detect fraudulent transactions in real-time, automate credit scoring, personalize customer experiences, ensure regulatory compliance, and optimize risk management.

The adoption process encompasses selecting appropriate AI solutions, integrating them with existing infrastructure, training models on financial data, and ensuring compliance with banking regulations while maintaining security standards.

The state of AI adoption in banking

Email has become a silent tax on every AI project in banking. The average professional spends 2.6 hours each day in their inbox. That adds up to almost 85 workdays a year. Senior banking leaders get even more messages, so they easily lose over 100 days annually to email management.

Three-quarters of that time is completely wasted. The damage is real. Email overload negatively impacts productivity, causing many employees to work extra hours, miss deadlines, and take longer to complete tasks.

While leaders struggle to keep up with their inbox, industry frontrunners are pulling ahead. Our State of Productivity AI report shows that industry-leading companies are 3x more likely to achieve significant productivity gains from AI. Banking executives who tackle inbox clutter first suddenly have capacity to guide pilots, refine models, and rally teams around change.

Think about it: communication still eats up half of a leader's workday when you add calendar management and chat messages to email. Those AI strategies sitting in slide decks rarely move forward because there's no time left to lead them.

Banks that recognize email as the primary bottleneck reclaim hours every week, giving executives the mental space to turn plans into results and close the growing AI adoption gap.

Why banks are prioritizing AI now

Competitive pressure, rising customer expectations, and the quest for operational efficiency leave banks racing toward AI. Instant fraud detection, hyper-personalized offers, and real-time risk models all promise a clear edge. Yet a quieter force shapes which institutions pull ahead: your inbox.

Banking leaders send about 77 emails and field more than 100 every day. Add nonstop pings and nearly a third of the workday disappears.

Even worse, most of that time is irrelevant noise. In banking, the burden hits harder because email remains the primary communication channel for 76.8% of customers and staff.

When you spend so much time triaging notifications, strategic work shrinks to the margins. Reactive mode feels unavoidable, yet it blocks the very initiatives meant to free capacity. AI experiments stall, data-governance workshops slip, and cross-team pilots never leave the slide deck.

The key drivers pushing banks toward AI include:

- Regulatory compliance demands: New regulations require sophisticated monitoring systems that only AI can handle at scale

- Customer expectations for instant service: Digital-first customers expect real-time responses and personalized banking experiences

- Fraud prevention at scale: Traditional rule-based systems can't keep pace with sophisticated financial crimes

- Operational cost reduction: Banks face pressure to reduce costs while maintaining service quality

- Competitive differentiation: Early AI adopters gain market share through superior customer experiences and faster decision-making

Winning banks break the cycle by attacking email first. With intelligent tools that auto-sort noise, draft routine replies, and highlight real priorities, leaders reclaim entire afternoons.

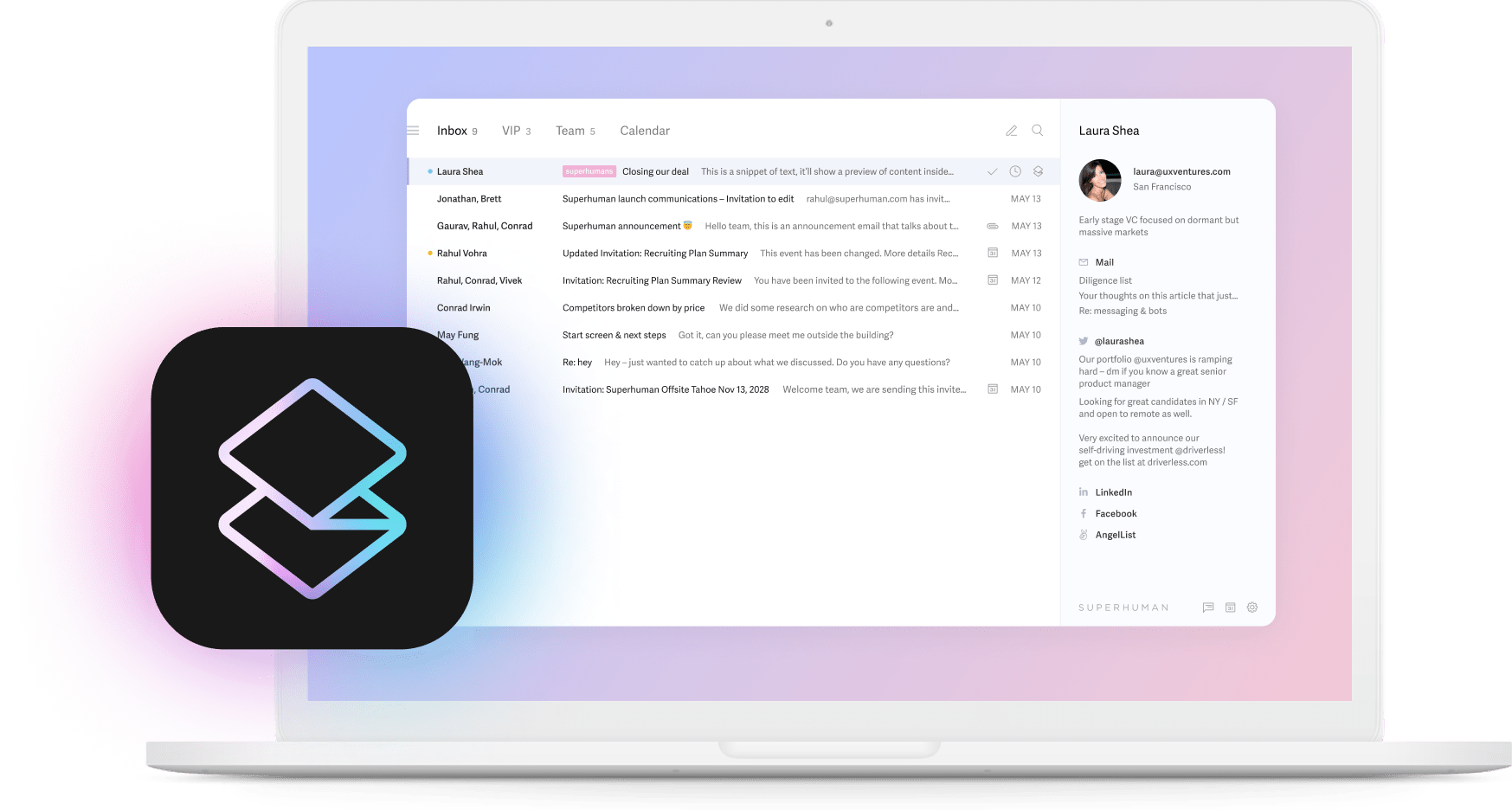

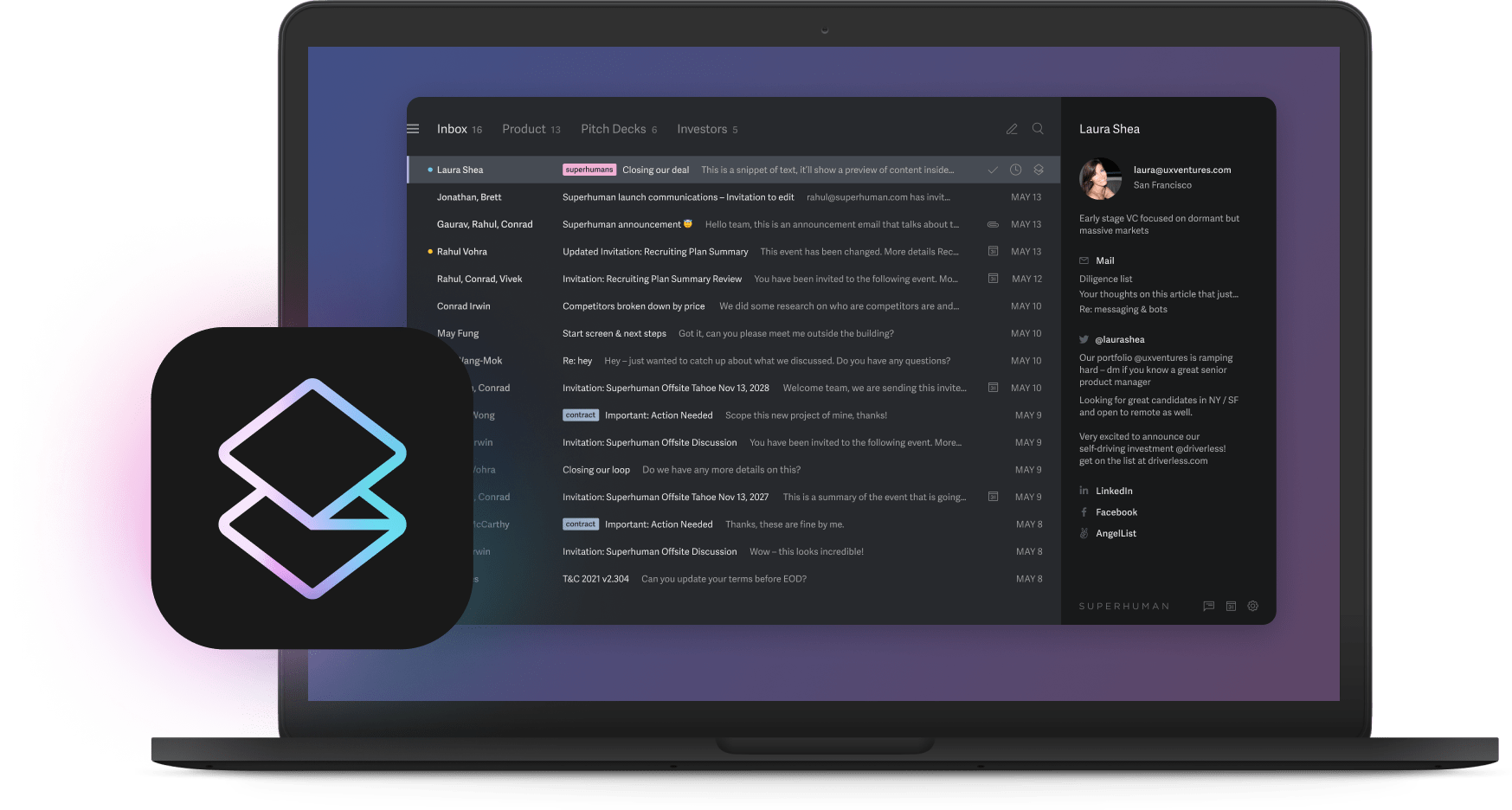

Teams using Superhuman save 4 hours every week, respond 12 hours faster, and handle twice as many email conversations in the same time. Those extra hours become the runway for pilot projects, vendor evaluations, and the change-management sessions that turn AI from aspiration into reality.

The takeaway is simple: competitive pressure pushes you toward intelligent automation, but inbox overload decides how fast you get there. Remove the blocker, and the roadmap accelerates itself.

High-impact use cases for AI in banking

Free your leaders from the inbox, and every other intelligent automation project moves faster. Right now nearly a third of an executive's workday disappears into email management. When half of leadership capacity is tied to low-value triage, ambitious machine learning programs stall before they start.

Start by deploying AI-native email. Smart prioritization lifts the most important messages to the top, tools like Auto Summarize turns long conversations into quick briefs, and intelligent scheduling finds clear focus blocks for deep work. That reclaimed attention is what sparks real transformation.

Once the blocker is gone, you can channel leadership focus into high-impact bank initiatives:

- Enterprise lending automation turns weeks of back-and-forth into real-time approvals

- Advanced fraud detection models scan transactions continuously instead of after daily batches

- Sophisticated compliance monitoring flags risky language before an email is even sent

- Next-generation customer service resolves most queries before they ever reach a human

- Risk assessment algorithms evaluate creditworthiness using thousands of data points instantly

- Personalized financial advisory delivers custom investment recommendations based on individual behavior patterns

Teams that adopt communication intelligence first create an instant productivity dividend. With inbox weight lifted, project cycles compress, decisions speed up, and automation adoption cascades across the organization.

Remove the hidden blocker, and the rest of your roadmap finally has room to run.

Building a winning AI adoption strategy

Start with the bandwidth you control, not the moon-shot you imagine. Banking leaders already spend about a third of each workday on email and much of that effort gets wasted on spam, long threads, or messages that should never have reached them.

Any grand automation roadmap will stall while that drain keeps running. The winning play is simple: deploy intelligent tools where they free leaders first, in the inbox.

Here's the smarter sequence that creates sustainable transformation:

- Remove the blocker first. Introduce AI-native email tools that triage, summarize, and draft so executives stop hand-sorting hundreds of messages. Replace basic Gmail or Outlook workflows with features like Split Inbox, and Auto Summarize. Hours return immediately.

- Create strategic bandwidth. Leaders who recover focus can finally steer fraud-detection pilots, lending automation, and other high-stakes intelligent programs. Use the freed capacity to carve out deep-work blocks for designing the full transformation strategy.

- Scale systematically. Execute enterprise automation projects with leaders who are no longer buried in their inbox. When leaders feel technology shrinking their own workload, they become vocal sponsors of wider transformation.

A practical timeline keeps the momentum visible. Start with AI-native email for the executive team in week one, expand to senior leadership within the first month, and use the recovered time to design comprehensive automation strategies. By year's end, you're executing enterprise programs with leaders who trust the technology because they've experienced its benefits firsthand.

The payoff is real. Organizations that introduce dedicated email productivity platforms report saving significant staff hours each month across their teams. According to our AI productivity report, Superhuman customers who use AI features save 37% more time than those who don't, accelerating gains even further.

Free your leaders first, and every other automation initiative moves faster, faces fewer approvals, and lands with a team that already trusts the technology.

Overcoming barriers to bank-wide AI scaling

Email is the hidden bottleneck. Until you free your calendar from endless inbox triage, every plan for bank-wide intelligent automation stalls.

First, the time problem creates a vicious cycle. Executives lose an entire workday every week to email management, and much of that time delivers zero value. Remove this blocker and you instantly reclaim those hours. The "no time for transformation" argument disappears when leaders have four extra hours weekly.

Second, resistance isn't what you think. Leaders don't resist technology that fixes their biggest pain. Show a pilot group reclaimed hours and resistance turns into demand. Early success creates internal champions who push automation adoption forward across the organization.

Third, email overload makes everything feel chaotic. When every request, alert, and compliance notice funnels through one channel, projects feel impossible to manage. Clear the inbox, and priorities sharpen. Leaders finally gain focus to map data needs, choose vendors, and steer pilots without constant context switching.

The most common barriers to AI scaling include:

- Legacy system integration challenges: Old banking infrastructure wasn't built for modern AI

- Data quality and silos: Fragmented data across departments prevents effective AI training

- Regulatory uncertainty: Evolving compliance requirements create hesitation

- Skills gap: Finding talent who understand both banking and AI remains difficult

- Change resistance: Teams comfortable with existing processes fear disruption

- ROI measurement difficulties: Quantifying AI benefits beyond efficiency gains proves challenging

This changes everything. You move from seeing intelligent automation as another initiative to viewing it as the fastest way to eliminate blockers. Start with inbox triage through filters, intent detection, Auto Summarize, and Split Inbox.

Then expand machine learning to fraud detection, lending, and customer experience. Banks that optimize their email processes improve deliverability, enabling critical insights to surface more quickly once noise is filtered.

Free up one workday each week, prove value in days, and complexity melts away. Banks that act now will scale intelligent automation faster than rivals still drowning in unread email.

AI adoption in banking: Transforming the competitive edge

Email drains your time. Banking leaders lose between a fifth and a third of every workday in their inbox, with most of that effort adding zero strategic value.

While your competitors polish transformation roadmaps, the banks pulling ahead take a different approach. They start by clearing the inbox. Remove the email blocker, create leadership bandwidth, then drive change.

Superhuman customers prove this works. They save 4 hours every week, handle twice as many email conversations, and make their inbox feel 10x lighter. The result? An executive team ready to lead transformation. Get started with Superhuman and watch your transformation accelerate.