Wall Street's biggest players keep throwing million-dollar packages at the same handful of machine learning PhDs. The supply stays thin while the bidding war gets uglier. You don't need to join that fight.

Smart financial leaders have figured out a better path. Skip the twelve-month recruiting nightmare and equip your existing analysts, controllers, and relationship managers with AI-native tools instead.

Your team already knows your business, understands compliance, and has your trust. They just need the right tools to fly through their workload.

According to Superhuman's State of Productivity & AI report, teams using AI save at least one full workday every week without hiring a single AI specialist. While your competitors burn cash on talent wars, you're already building capabilities that deliver results.

What is AI adoption in financial services?

AI adoption in financial services refers to the implementation of artificial intelligence technologies to automate processes, enhance decision-making, and improve customer experiences within banking, insurance, investment management, and other financial institutions.

This encompasses machine learning algorithms for risk assessment, natural language processing for customer service, predictive analytics for fraud detection, and automated systems for regulatory compliance.

You have two paths. An AI-dependent approach demands bespoke models, specialist hires, and months of integration.

An AI-native approach ships ready-made models behind an interface your analysts already know. You click, configure, and start seeing insights within days.

High-growth firms gain even more. With fewer legacy systems and leaner approval chains, you roll out new workflows quickly while larger rivals wait on hiring committees.

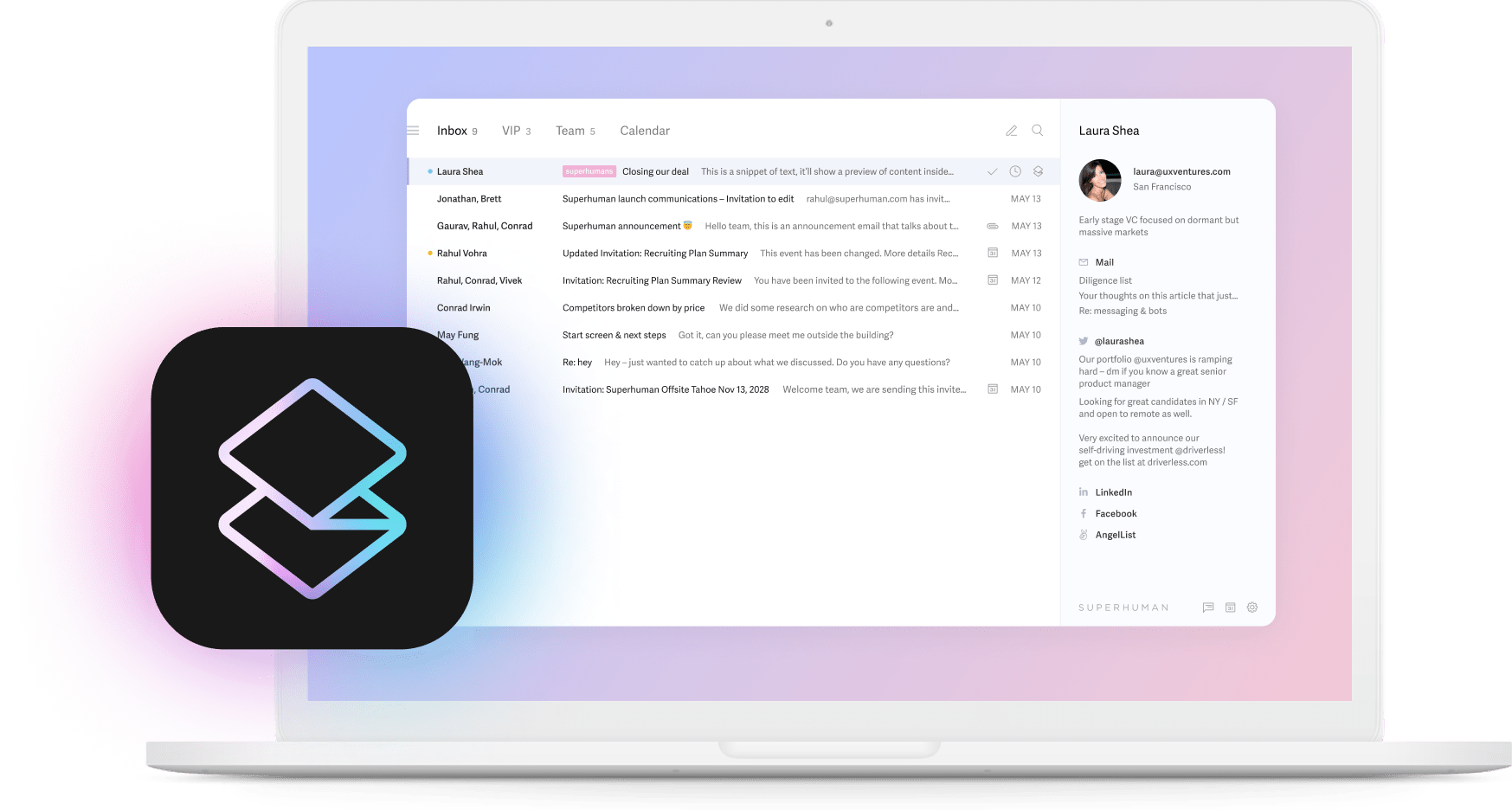

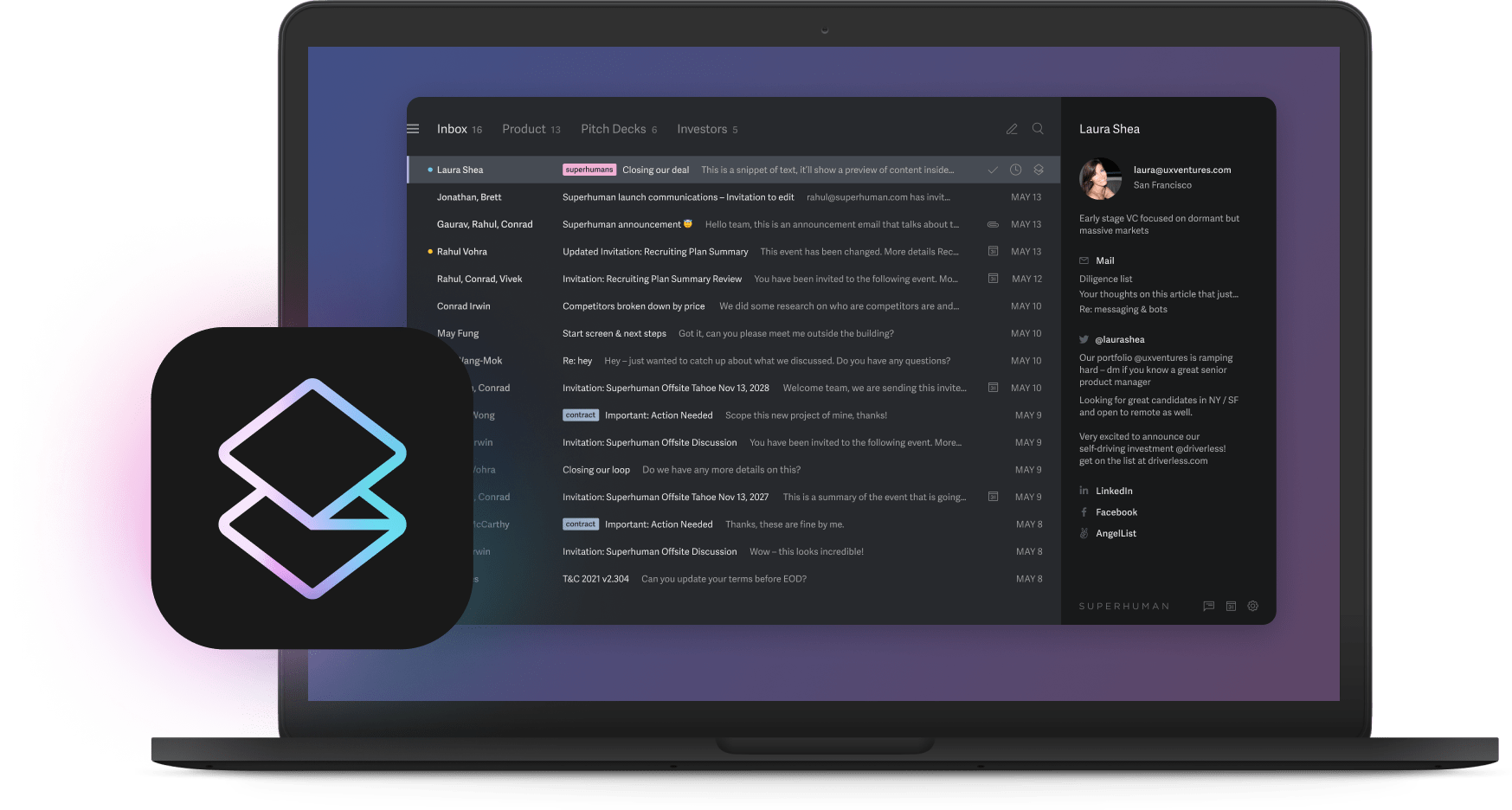

Tools like Split Inbox automatically categorize financial communications so your relationship managers never dig for critical messages, yet nobody on the desk needs to tweak an algorithm.

Market overview: The talent war creating your opportunity

Big banks keep escalating salaries for scarce AI specialists, yet the prize often slips away. Many costly machine learning initiatives stall in experimentation without reaching positive ROI. Even firms with the largest specialist headcounts struggle to turn skill into market advantage.

This gap opens a window for you. Instead of waiting months to recruit an elusive machine learning engineer, you can deploy AI-native platforms that your existing finance team configures in a few clicks.

According to our AI productivity report, teams respond to twice as many emails and save 4 hours every single week without even hiring specialists, so it’s definitely possible.

Core drivers for AI adoption: Why "build, don't buy" is your competitive edge

You need outcomes now, not after a year of recruiting. AI-native tools can be live in weeks. Here's what makes the build-don't-buy approach powerful:

- Speed to deployment: Get AI running in weeks versus months of recruitment cycles

- Cost efficiency: Subscription plans start at thousands per year versus six-figure specialist salaries plus recruiting fees

- Team-wide impact: Every employee gets AI capabilities, not just one new hire

- Lower risk: Month-to-month software costs versus long-term employment commitments

- Built-in compliance: Vendor-maintained models include regulatory updates automatically

Retention is steadier when you grow talent from within. Your analysts already understand your risk models, regulatory constraints, and customer nuance. Upskill them with intuitive AI dashboards and they stay engaged.

The real payoff is the compound effect. When everyone has an AI sidekick, productivity multiplies. For example, Instant Reply learns your team's writing style without manual training, so responses sound like you and land in seconds.

Multiply that speed across hundreds of daily tasks like document reviews, credit checks, and compliance summaries.

The talent-speed paradox: Reframing the challenge as opportunity

Too many financial leaders stall because they think artificial intelligence adoption starts with hiring rare, million-dollar specialists. While rivals post eye-watering salaries and wait through months of recruitment, you can move today with AI-native tools that anyone on your team can use.

Speed gives you the first advantage. A low-code platform runs in weeks, pulling data from core systems and delivering recommendations the moment a credit officer opens the dashboard. Ten employees armed with AI-native apps review more documents, service more customers, and surface more insights than a single data scientist coding bespoke models.

AI adoption in financial services: High-impact use cases

Picture a credit analyst dragging files into a browser and getting an instant credit score. Pre-trained, AI-native models handle the heavy lifting, so you only adjust policy thresholds instead of writing code.

Nest Bank rolled out Microsoft Copilot to everyday staff, reclaimed hours of administrative time, and redirected that time to product innovation.

National Bank of Greece cut document review to 0.5 seconds per page while hitting 90% accuracy, thanks to an AI document processor configured by operations staff, not data scientists.

Radius Bank implemented Oracle CX Service to integrate multiple data sources for a unified customer management platform; Deployed AI-driven alerts to identify and retain customers poised to defect; Introduced a digital assistant, Rae, to enhance customer service efficiency and satisfaction.

This resulted in saving millions of dollars in customer deposits by retaining clients; Net Promoter Score increased by 20%; and Reduced average customer handling time by one minute.

Portfolio teams see similar results. No-code analytics platforms sift through market data, flag anomalies, and draft scenario analyses at the click of a button. Risk groups deploy drag-and-drop machine learning tools to spot fraud patterns earlier than rule-based systems catch them.

Back-office automation handles reconciliations, invoice matching, and payroll checks, turning end-of-month crunch time into routine maintenance. Think of it like Snippets inside your inbox. Create a template once, and anyone can reuse it without worrying about the underlying logic.

Building your internal AI capability engine

Start with a tool your team can open in a browser and use right away. AI-native platforms come with drag-and-drop flows, built-in data connectors, and dashboards that explain what's happening.

Pick a handful of high performers and name them your AI Champions. Their job is simple: test the tool on one repetitive workflow like reconciliations or first-draft board packs, then share the time saved with the rest of the floor. 46% of financial institutions that heavily invest in structured upskilling see meaningful progress, while only 11% with no program fall behind.

Key implementation steps:

- Start small: Choose one high-volume, repetitive process for your pilot

- Measure impact: Track minutes saved per task, not models deployed

- Share wins: Broadcast small victories to build confidence

- Scale gradually: Move from individual champions to team adoption to firm-wide rollout

- Iterate continuously: AI tools improve with each click, as will your people

Governance and risk: Simpler with the right approach

Choose an AI-native platform and you simplify financial regulations instead of getting tangled in them. These tools come with privacy, security, and explainability built in.

Trust remains the main barrier for finance leaders experimenting with autonomous AI, according to Deloitte research. Commercial platforms solve this through human-in-the-loop workflows, detailed model cards, and continuous monitoring dashboards.

You see why a model reached a decision, you can override it instantly, and every action gets logged for auditors.

Audit trails come standard. Proven vendors timestamp each model change, store training data lineage, and surface granular access logs. That visibility shrinks examination cycles and reassures risk committees that nothing hides in a black box.

Model risk drops too. Instead of a custom algorithm maintained by a tiny internal team, you rely on platforms hardened across thousands of customers and updated the moment new threats or compliance rules emerge.

When you evaluate a tool, confirm it offers explainability reports you can share with auditors, role-based access controls tied to corporate identity systems, data encryption in transit and at rest, and versioned model management with rollback.

Your 90-day implementation roadmap

You can turn artificial intelligence from buzzword to bottom-line impact in three months.

Days 1-30: Pick one workflow that's driving everyone crazy. Think underwriting checklists or document reconciliation. Give it to a small pilot group of people who already love trying new tools. Choose AI-native platforms that need zero coding. Pre-built connectors get you live in days, not months.

Days 31-60: Shift from excitement to evidence. Track the metrics that matter like hours saved, faster turnaround times, and fewer errors. Aim for at least 25% less manual work by week six. Share quick wins in your weekly meetings.

Days 61-90: Time to scale. Follow the playbook that works by automating onboarding, creating short video walkthroughs, and celebrating every milestone. Keep audit trails active and review them weekly so governance stays tight.

By day 90, your team runs the tools, productivity compounds, and that million-dollar talent war feels like someone else's problem.

From talent shortage to competitive advantage

You don't beat a talent shortage by bidding harder. You beat it by changing the game.

AI-native tools shift the focus from headcount to hours saved and smarter decisions. While firms using low-code platforms sprint ahead of bigger rivals, others remain stuck in expensive hiring cycles.

Each AI-native team member shares insight instantly, turning your workforce into a self-reinforcing network. You scale faster and cheaper because the people who already know your customers and compliance rules keep improving the system.

Superhuman shows this pattern in action. Its artificial intelligence learns your writing and doubles response speed without adding a single specialist. Teams reply 12 hours faster and handle twice as many emails in the same time.

AI adoption in financial services: Next steps

You're facing two paths. Keep chasing million-dollar AI specialists when most financial firms have nothing to show for it. Or empower the team you already trust with AI-native tools that deliver results in weeks.

Smart leaders are choosing the second path. They're using tools like Superhuman to help their teams save 4 hours per person every week, respond 12 hours faster, and handle twice as many emails in the same time. Get started with Superhuman and discover how your current team can unlock hours of freedom while making email what it should have been all along.