Speed now defines survival for insurers racing to adopt AI. While you're waiting for another pilot sign-off, your rivals are shipping models that settle claims in hours and underwrite policies in real time.

The gap widens fast. Industry leaders using AI and digital technologies see 6.1x greater total shareholder returns within five years.

What felt like an innovation project yesterday became an existential deadline today. This guide shows you how to move from multi-year roadmaps to production in weeks, so your organization thrives instead of vanishes.

What is AI adoption in insurance?

AI adoption in insurance refers to the implementation and integration of artificial intelligence technologies into core insurance operations, including underwriting, claims processing, customer service, and fraud detection.

This encompasses machine learning models, natural language processing systems, computer vision applications, and predictive analytics platforms that automate decision-making and enhance operational efficiency.

The adoption process involves transitioning these technologies from experimental phases to full production environments where they handle real policies, process actual claims, and interact with customers daily.

Success is measured by operational deployment rate, processing speed improvements, cost reductions, and the percentage of workflows automated versus those remaining manual.

AI adoption: The implementation bottleneck crisis

You know intelligent automation can reshape insurance. The real problem? Getting it into production fast enough. Too many carriers are stuck in pilot purgatory where proof-of-concept projects drag on for months, dashboards collect dust, and customers never see the benefits.

While 90% of insurers are exploring generative AI, only 55% have deployed anything. Start-ups ship models live in 30 to 60 days. Traditional carriers spend six months just getting pilot approval.

Here are the key costs of delayed implementation:

- Lost savings: Automated claims processing delivers $6.5 billion in annual savings industry-wide, meaning every month of delay costs roughly $541 million

- Talent drain: Data scientists get frustrated watching their models sit unused and leave for faster environments

- Competitive disadvantage: Early movers see 22% lower operational expenses

- Data gap: Production systems learn continuously from live claims and customer interactions, creating advantages that compound daily

Insurance culture values certainty above speed. Leaders form committees, draft policies, and rewrite risk frameworks instead of shipping software. Each dataset competitors collect improves their pricing, fraud detection, and loss prediction. The longer you wait, the harder it gets to catch up.

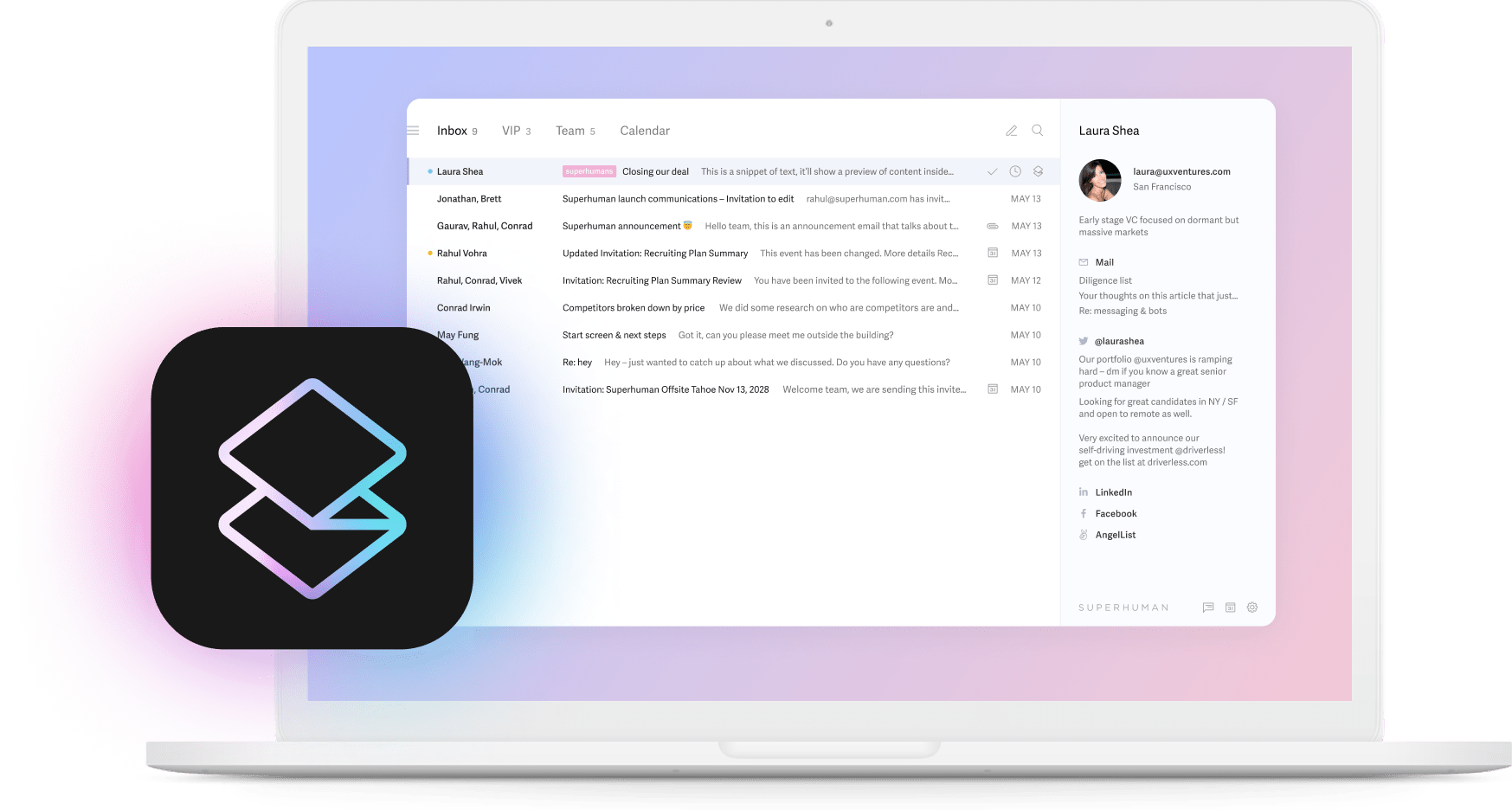

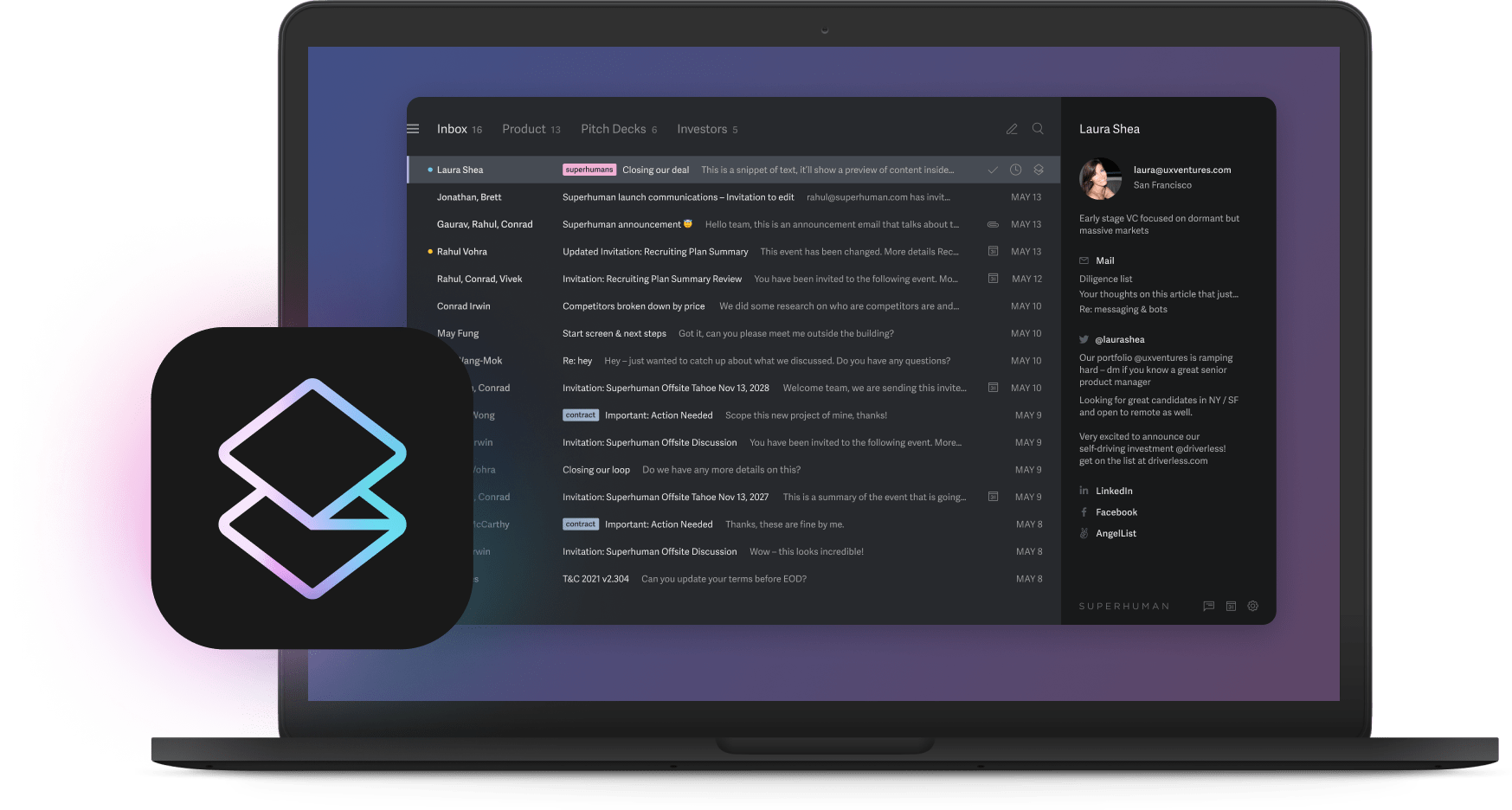

Break out of pilot purgatory, get your models into production fast, and let real customer feedback make them better. With tools like Split Inbox in Superhuman, teams can prioritize critical implementation emails and move faster through approval processes.

AI adoption drivers in insurance

Speed decides whether you keep customers, talent, and market share. Every driver of adoption boils down to how fast you turn data into decisions.

Customer expectations hit first. Digital self-service became the default, and 42% of insurance interactions already flow through intelligent assistants. When policyholders settle claims or adjust coverage in seconds, they won't wait in call-center queues.

According to Superhuman's State of Productivity AI report, customers using AI save 37% more time than those who don't, setting new benchmarks for response speed across industries.

Operational efficiency makes the business case obvious. Automating claims cuts cycle time by 75% and trims operating expenses by 22%. Teams using Auto Summarize can digest complex claim documentation and make faster decisions.

Talent follows momentum. Engineers and data scientists want their models in production, not stuck in endless pilots. Our AI productivity report shows that top-performing companies are 3x more likely to report significantly increased productivity from AI.

Core use cases for AI adoption in insurance

Think of AI-native tools as shortcuts that help you capture value in weeks, not quarters. The fastest wins happen in high-volume workflows where clean data and feedback loops already exist.

Start with claims processing. Automating first notice of loss, document triage, and payment recommendations cuts processing time by up to 75%. Most insurers can pilot a claims model in under 45 days because historical claim files give the algorithm plenty to learn from.

Underwriting comes next. Machine-learning models prefill applications, score risk, and flag unusual cases, shrinking time-to-quote by 40%. Using Instant Reply helps underwriters respond to broker queries twice as fast, keeping deals moving forward.

Customer service follows closely. Chatbots now resolve the majority of customer interactions, giving policyholders 24/7 answers and freeing human agents for complex cases. Pair the bot with intelligent document processing that extracts data from policies, medical notes, or police reports.

Fraud detection rewards speed, too. Predictive analytics flag suspicious patterns early, driving a boost in detection rates and reducing loss ratios within a single renewal cycle.

When you decide where to start, rank each use case by time to value, implementation complexity, and business impact.

Real-world AI adoption examples

Speed separates winners from losers. Look at insurers shipping intelligent systems and you'll see a playbook built on weeks, not quarters.

Allianz deployed its 'Incognito' computer-vision engine across motor and home claims and boosted fraud detection rates by 29%. Fast feedback loops mean every suspicious image trains the next model version.

Aviva picked claims assessment as its testing ground. Working with Tractable, it moved photo-based damage estimation from concept to customer phones, cutting complaints by 65% and saving £100 million. The team ships updates every two weeks that shave seconds off review time and feed new scenarios back into training data.

Compare that with companies stuck in endless pilots. Traditional carriers run six-month proofs of concept that never escape testing environments. While they deliberate, leaders capture the compounding advantage.

Smaller digital-native insurers make the contrast even starker. With cloud-first systems, they push a prototype to production in 30 to 60 days and iterate every quarter. Each release cuts handling costs, speeds settlement, and builds a data advantage that late adopters can't match without massive investment.

Pick areas with clear value, build a small team, and ship fast. Teams using Shared Conversations can collaborate on implementation decisions in real-time, eliminating the back-and-forth that slows deployment.

Barriers and challenges to adoption

Talent shortage tops every obstacle list. 52% of insurers flag skill gaps as their main barrier to progress. Without data scientists and engineers, projects stall before they start.

Data problems create the next roadblock. 40% of carriers struggle with poor data quality and broken integrations. Legacy systems keep policy, claims, and customer records isolated.

The most significant implementation barriers include:

- Regulatory uncertainty: 36% of insurers cite regulatory challenges, with unclear guidance around explainability and fairness

- Organizational doubt: 38% of insurers worry automation won't deliver promised results

- Security concerns: 32% fear security and compliance challenges from AI implementation

- Budget cycles: Annual planning creates committee paralysis when speed matters most

- Perfectionism: Demanding 100% accuracy before launch while competitors ship 80% solutions and improve rapidly

Solutions to overcome AI adoption barriers

Speed depends less on technology and more on how you deploy it. Skip pilot purgatory by choosing systems that are already tuned for insurance. Vertical, pre-built models let you launch in days, then customize outputs once value is visible.

This directly addresses insurers who doubt results will meet expectations and those concerned about expanding cyber risk, because tested solutions arrive with proven benchmarks and hardened security controls.

Small, autonomous squads accelerate delivery even inside complex enterprises. Give a cross-functional team clear ownership and decision rights, then set a weekly shipping cadence. Releasing incremental upgrades forces rapid feedback loops and prevents committee paralysis.

Aim for an 80% solution on day one and improve it in production rather than waiting for perfection.

Legacy infrastructure no longer justifies delay. Cloud APIs and low-code connectors let you run new models in parallel while core systems remain untouched. Start with the cleanest datasets tied to a single use case and expand once returns are measurable.

Combat talent gaps by upskilling domain experts who already understand underwriting and claims. Focus learning programs on model monitoring, prompt engineering, and ethical reviews.

According to our AI productivity report, leaders cite "the ability to improve efficiency with new technology" as what most sets their top performers apart.

Secure executive sponsorship that measures success by time-to-value. Track metrics like days from idea to production, weekly model accuracy gains, and reduction in manual touches. When leadership rewards shipping speed, adoption shifts from annual roadmap discussion to everyday habit.

With Snippets, teams can share successful implementation templates across departments, accelerating rollout speed.

AI adoption in insurance: Conclusion

The insurers who thrive will be those who treat every day as a deadline and every deployment as a learning opportunity. Speed isn't just an advantage anymore. It's the price of admission.

Ready to accelerate your team's productivity and join the companies saving 4 hours per person every week? Start your Superhuman journey today and see why teams using our AI-native platform respond to twice as many emails in the same amount of time.