Most opportunities in your CRM will never close. You know it. Your team knows it. Yet every quarter, you report pipeline numbers that everyone pretends to believe.

Here's what changed: AI sales pipeline management now calls out the lie. Machine learning examines every deal against thousands of historical patterns and doesn't care about your quota. That opportunity stuck in negotiation for six months? Dead. The champion who ghosted you? Gone. The verbal commit with no follow-up? Never happening.

Companies implementing AI are watching their reported pipelines shrink by 30-40% overnight. Stock prices are dropping when the truth comes out. PE firms won't even take meetings without running algorithmic audits first. The comfortable fiction that kept everyone happy is ending, and the reckoning has already started.

When AI torpedoes the forecast

The quarterly review starts normally. Good pipeline coverage, confident projections. Then data science shares their screen. Their AI model shows the real pipeline is 30% smaller than what you just presented.

"Walk me through the difference," the CEO says. The data lead lists what the algorithm found: deals sitting too long in late stages, zero engagement from decision makers, email response rates dropping to nothing. The CRO protests about relationships and context. The response is brutal: "The model tracks relationship patterns. These relationships are dying, not strengthening."

This scene repeats everywhere now because the fundamental disconnect between hope and reality can no longer be hidden. What looked like healthy pipelines crumble under algorithmic scrutiny. The mutual agreement about what counts as a "real" opportunity evaporates when pattern recognition doesn't care about making quota. And once leadership sees this gap, they can never unsee it.

Who lies and why

A rep has quota to hit. When a prospect says "interesting, let's talk next quarter," they mark it qualified. Their manager sees it but says nothing because their bonus depends on coverage. This small deception sets off a chain reaction that corrupts the entire forecast.

The director adds optimism when reporting up because showing weakness invites scrutiny. The VP rounds up further because the board expects growth. By the time it reaches the C-suite, fiction has replaced fact. Nobody's lying exactly. They're seeing what they need to see. Humans are wired for optimism, and sales amplifies this. We overestimate good outcomes and ignore warning signs. Add commission pressure and the bias gets worse.

But here's why this matters: the system actually rewards this behavior. Big pipelines get you resources and headcount. Honest pipelines get you fired. So everyone plays along. Reps protect income, managers protect teams, executives protect stock prices. The game works perfectly until someone actually looks at the data. AI always looks, and that's when the entire house of cards collapses.

What AI finds

Machine learning examines thousands of data points hourly, comparing every interaction against winning patterns. Email analytics reveal when "committed" buyers haven't opened a message in weeks. Natural language processing grades interaction quality. The algorithm separates real progress from busy work. And what it finds is devastating.

Zombie deals

Deals die but nobody buries them. They sit in late stages with no real activity because removing them shrinks the forecast. But AI times every stage against historical patterns. When opportunities exceed normal duration with no progress, they get flagged. The pattern is so consistent it's almost mathematical.

Companies discover huge portions of their late-stage deals have zero recent contact. Reps insist the relationships are warm, but the data tells a different story. Months later, every flagged deal dies exactly as predicted. The algorithm knew what humans refused to admit.

Phantom champions

Champions leave but pipelines pretend they're still there. AI watches email patterns for vanishing contacts. Response times slow, message lengths shrink, enthusiasm fades. The algorithm catches what reps ignore because it has no emotional investment in the outcome.

Instead of discovering during a failed close that your champion left months ago, AI shows relationship decay in real time. The tragedy is that most teams see these warnings and ignore them. They ride deals to predictable death rather than face uncomfortable truth. This denial costs millions in wasted effort, but admitting failure feels worse than actual failure.

The valuation cliff

Implement AI forecasting and watch what happens. Stock prices drop when honest numbers go public because the market hates surprises more than bad news. But the real damage goes deeper than a single bad quarter.

Growth companies trade at revenue multiples. Miss your forecast and those multiples compress. Questions arise about execution and credibility. Billions in market cap vanish. The truth hurts, but hiding it hurts more because trust, once broken, takes years to rebuild.

PE firms learned this lesson and adapted. They now run AI audits before investing. They upload your CRM data and let algorithms find the truth. When the model shows your pipeline is half fantasy, valuations get cut accordingly. No accusations, just adjusted offers based on reality. The smart money no longer takes your word for it.

Some companies think they can game this system. They try running two pipelines: honest internally, inflated externally. This ends badly. Someone always compares the numbers. Then you're explaining securities fraud instead of missed forecasts. The short-term benefit never justifies the long-term consequences.

Happy ears meet cold math

Sales culture rewards hearing what you want. "Interesting" becomes "they love us." A question becomes "ready to buy." Our brains filter out negative signals when we want something to be true. This isn't weakness; it's human nature amplified by incentive structures.

This compounds through organizations like a game of telephone. Reps hear buying signals everywhere. Managers add their optimism. By the boardroom, vague interest has become sure things. Each layer adds distortion until the final number bears no resemblance to reality.

AI breaks this cycle completely. It weighs variables without emotion or quota pressure. That interested prospect who went dark two weeks ago? Minimal close probability. The verbal commit with no follow-up? The algorithm knows better. Smart email tools automate this analysis, tracking engagement patterns and flagging cooling interest. Instead of chasing ghosts, you can finally focus on real opportunities. The shift feels harsh because it strips away comforting illusions, but clarity beats false hope every time.

Why top performers quit

Your best rep just left. Twenty years of closing deals through instinct and relationships. Then AI scored their pipeline and flagged half as unlikely. They felt insulted and quit. This story plays out everywhere because it strikes at professional identity.

The old guard built careers on gut feel. Now machines question their judgment. Every trick that inflated pipelines now gets exposed. Stalled deals pushed forward? Flagged. Zombie opportunities? Highlighted. Creative forecasting? Under scrutiny. What once made them successful now makes them suspect.

Yet AI can liberate good sellers. It handles tracking and follow-up automatically. Email automation ensures nothing falls through cracks. Instead of managing spreadsheets, have real conversations. Progressive leaders use AI insights for coaching, not punishment. They show reps how data makes them better, not obsolete. Those who adapt discover a powerful ally. Those who resist run out of places to hide as adoption spreads. The profession is splitting between those who embrace augmentation and those who cling to the past.

PE's new weapon

Private equity arrives with AI tools that scan your entire sales history in hours. They ingest CRM exports, analyze patterns, and adjust valuations based on what they find. What once took weeks of meetings now happens in an afternoon of algorithmic analysis.

Due diligence regularly reveals that "commit" deals have no recent activity. Forecasts shrink under scrutiny. CEOs field hard questions about which numbers reflect reality. Deals collapse when the gap grows too large. Years of relationship building evaporate when the data contradicts the story.

Even email patterns matter now. Low response rates and growing response times feed the model. Companies with healthy engagement pass easily. Those with zombie pipelines face painful conversations. The algorithm doesn't care about your explanations, only your data.

The lesson is brutal but clear: audit yourself before investors do. Clean dead deals, align stages with reality, document real engagement. When PE shows up with algorithms, hope isn't a strategy. The companies that survive this new reality embrace transparency before it's forced upon them.

Running dual pipelines

Keep two sets of books and eventually someone notices. The logic seems sound: markets punish honest forecasts, employees need optimistic targets, so why not manage different narratives? Because it always explodes, and when it does, the damage extends far beyond missed numbers.

Companies face SEC investigations when dual pipelines surface. Securities fraud starts with misleading investors about material facts. Pipeline forecasts directly impact valuation. Two versions means documented deception. What starts as narrative management becomes criminal evidence.

Smart companies do the opposite. They use AI for one source of truth, then communicate ranges: "Our model shows $30-35M with 70% confidence." This transparency might cause short-term pain but builds long-term credibility. Markets reward predictability over promises. Investors prefer conservative accuracy to optimistic fiction.

Six months down, three years up

Month one brings denial: "The algorithm doesn't understand our business." Month two brings anger: "This is killing morale." Month three brings bargaining: "Can we adjust the model?" Month four brings acceptance. The pipeline shrinks 30-40%. Forecast accuracy jumps. The pain is real but so is the clarity.

By month six, the transformation accelerates. Win rates climb because reps focus on real deals. Response times drop through automation. Marketing learns what converts. The pipeline is smaller but real. Resources previously wasted on fiction now drive genuine opportunities.

Year two brings compound benefits. Accurate forecasts enable real planning. Hiring matches actual growth. The business runs smoothly on truth instead of hope. Trust builds between departments as everyone works from the same numbers. The cultural shift from optimism to realism creates sustainable growth.

Year three sees revenue growth far exceeding the initial drop. Not because AI creates deals, but because humans stop wasting time on fiction. Every hour moved from fake to real opportunities compounds. Companies that made this transition early dominate their markets while competitors still chase ghosts.

Making the transition

Set deal age limits based on historical data. When deals exceed limits, move them back or out. This simple rule kills most inflation. But limits alone aren't enough. You must also require evidence for stage advancement. "Proposal" needs a proposal request. "Negotiation" needs a contract. No evidence, no movement. These requirements transform pipeline quality overnight.

Track engagement religiously. Email opens, response times, meeting attendance. Two weeks dark means at risk. Three weeks means dead. Hope is not a strategy. More importantly, change incentives from pipeline size to pipeline accuracy. Reward reps who forecast accurately, not optimistically. This single change aligns behavior with reality faster than any training.

Communicate clearly: "We're moving from stories to data. First quarter hurts, fourth quarter thrives." Then stick to it when people complain. Use AI for coaching, not punishment. Share insights to help reps improve. When the CEO admits their pet deal is dead based on AI analysis, everyone gets the message. Cultural change flows from authentic example, not corporate mandate.

The future belongs to the honest

Pipeline theater is ending. For decades, sales ran on optimism and mutual fiction. AI doesn't play along. The transition will be painful as companies built on fantasy see valuations corrected and sales teams living on false hope face reality.

But what emerges will be better: forecasts you can trust, teams focused on real opportunities, companies valued on actual performance. AI sales pipeline management forces truth in a world of lies. You can embrace it voluntarily or have it forced upon you.

The winners move first because reality beats fantasy every time. When you stop lying about your pipeline, you can start building one that actually delivers. The question isn't whether to adopt AI forecasting. The question is whether you'll lead the change or be crushed by it.

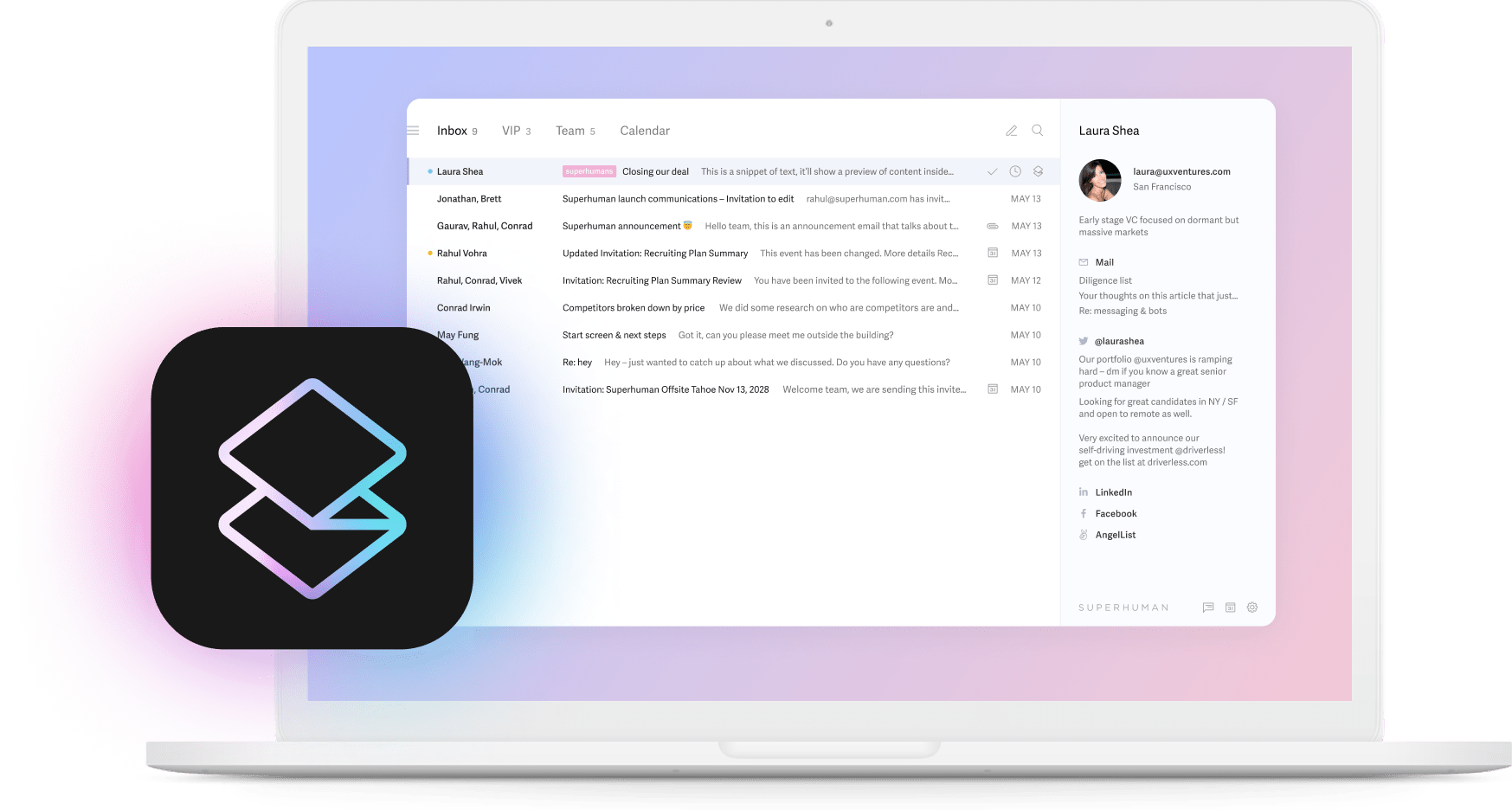

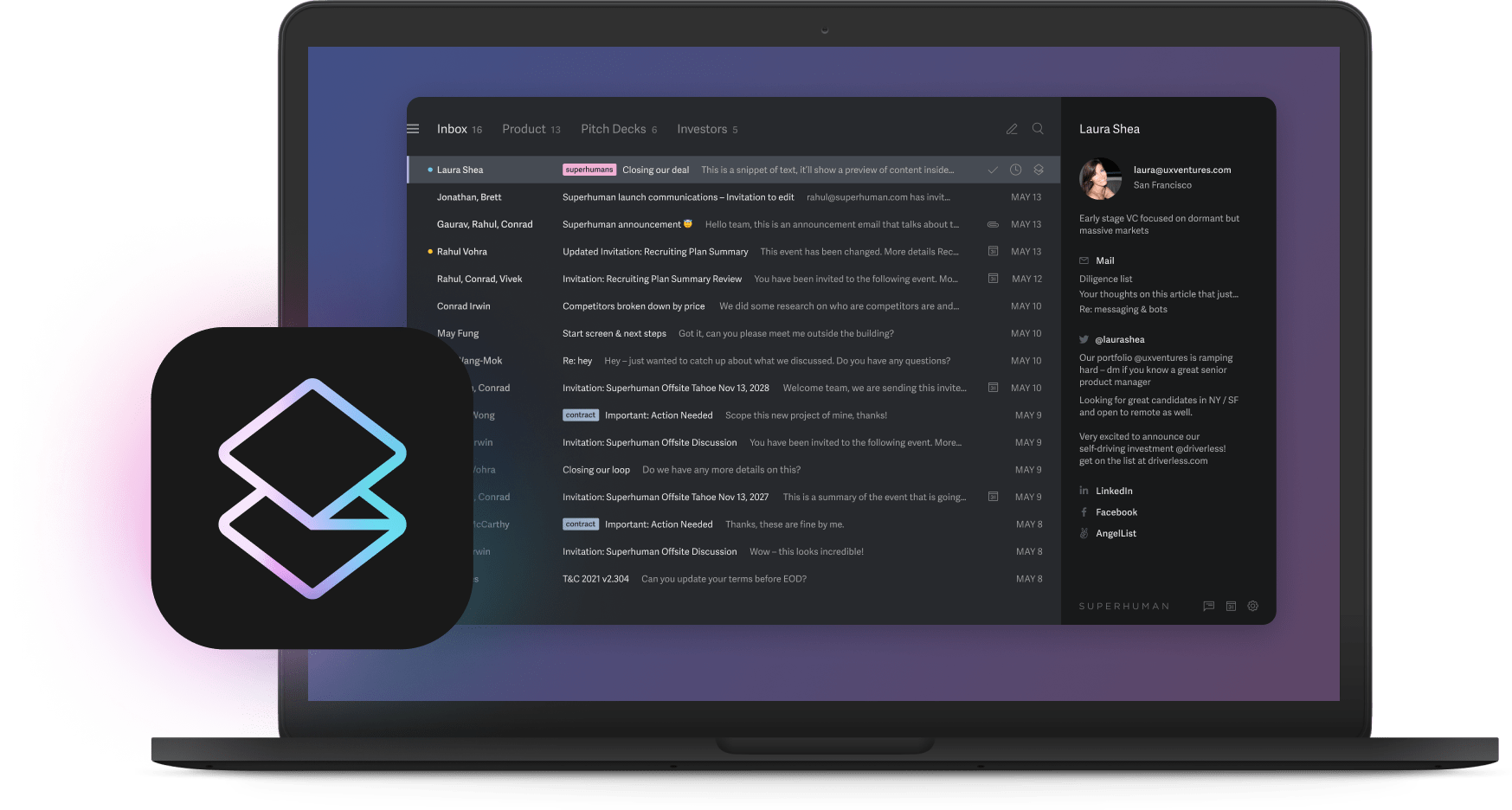

Teams using Superhuman save 4 hours per person every single week. They respond to twice as many emails in the same time. The most productive email app ever made helps teams fly through their inbox, turning every interaction into an opportunity to build genuine relationships that create real pipeline value.