Your morning routine is perfect. You've tweaked your inbox zero ritual. You've read every productivity book. Yet when you sit across from venture capitalists, those habits mean almost nothing compared to what's happening inside your organization.

VCs care about delegation charts, meeting cadences, and governance systems. They want proof your company can run at scale. They dig into how often you review KPIs, whether decision rights extend beyond your founding team, and how clearly you communicate risk. VCs look for traits like humility and resilience, often using assessment tools to measure them objectively.

The reality hits hard. You either evolve from founder-mode to CEO-mode or get stuck at your next funding round. This article breaks down four organizational practices that catch investors' attention. Master them and you signal you're ready to scale. Ignore them and you'll stay stuck pitching potential instead of showing proof.

We're talking about operational cadence, data-driven decision loops, systems that work without you, and strategic board management. You won't find these practices in typical entrepreneur success books, but they determine whether you get that term sheet.

Operational cadence over visionary chaos

Morning rituals sharpen your focus, sure. But VCs zero in on the routines that steer your entire company. They inspect how rhythm shows up on Monday mornings, not in your personal journal.

Your leadership team gathers every Monday to review a metric dashboard covering revenue, burn, and churn. Everyone leaves with owned actions and clear deadlines. Mid-week, you meet again to track OKRs. Any goal that slips triggers a post-mortem within 48 hours. That loop proves your business can learn and adjust at speed.

During due diligence, investors call this "rhythm and discipline of execution." They look for repeatable cycles, transparent metrics, and fast feedback loops. All of these signal scale-readiness and reduce key person risk. Some leadership experts suggest structured operating reviews support board readiness in founders, though published research hasn't yet identified them as a leading indicator of board-ready CEOs.

Consider a Series B board meeting. Revenue hits target, but expansion ARR trails plan. The founder flips to a slide detailing the weekly rhythm: Monday KPI sync, Wednesday customer-success stand-up, Friday deal desk retro. Each routine lists owners and next steps. The board sees a system, not ad-hoc heroics, and extends the term sheet.

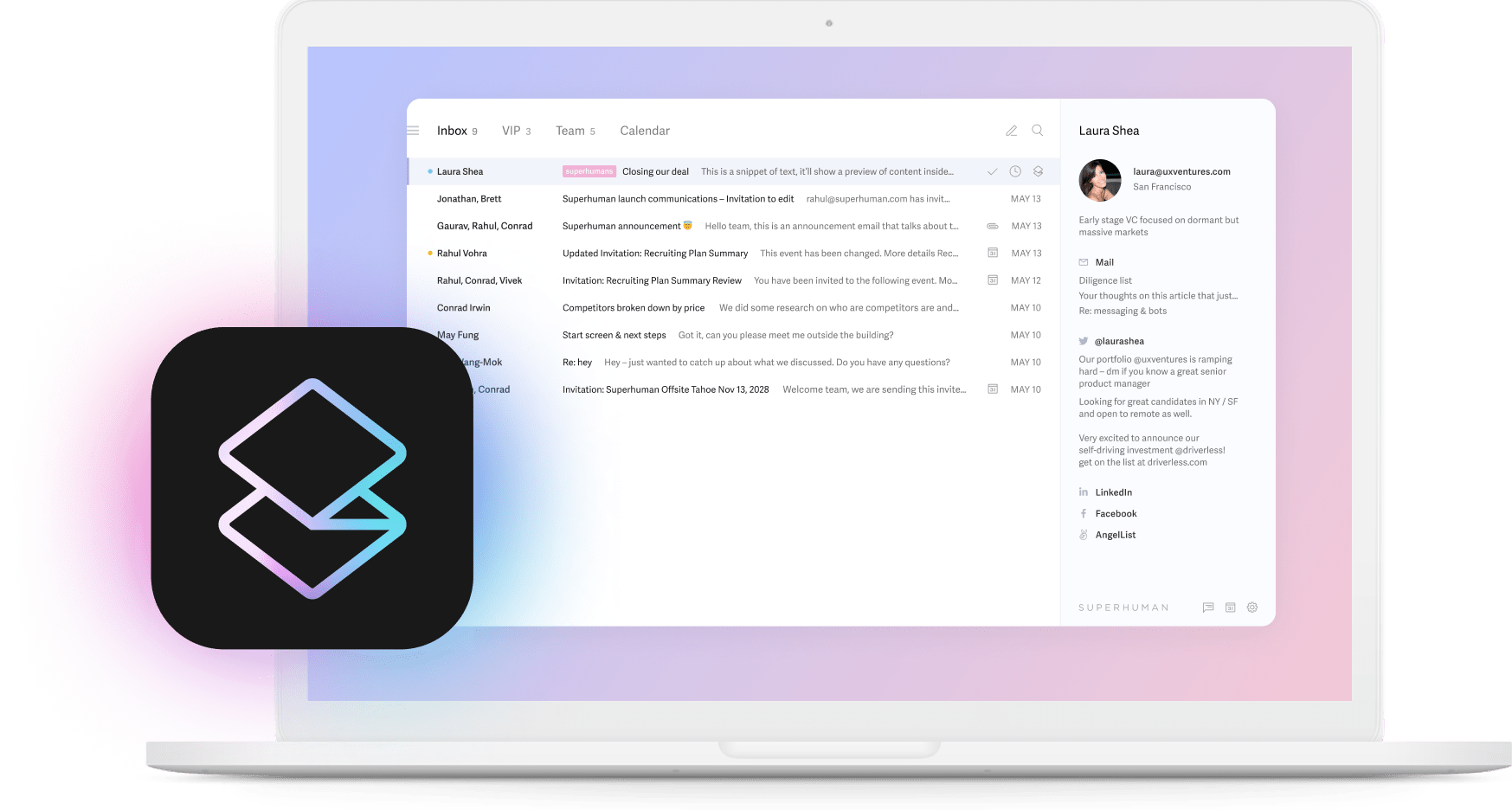

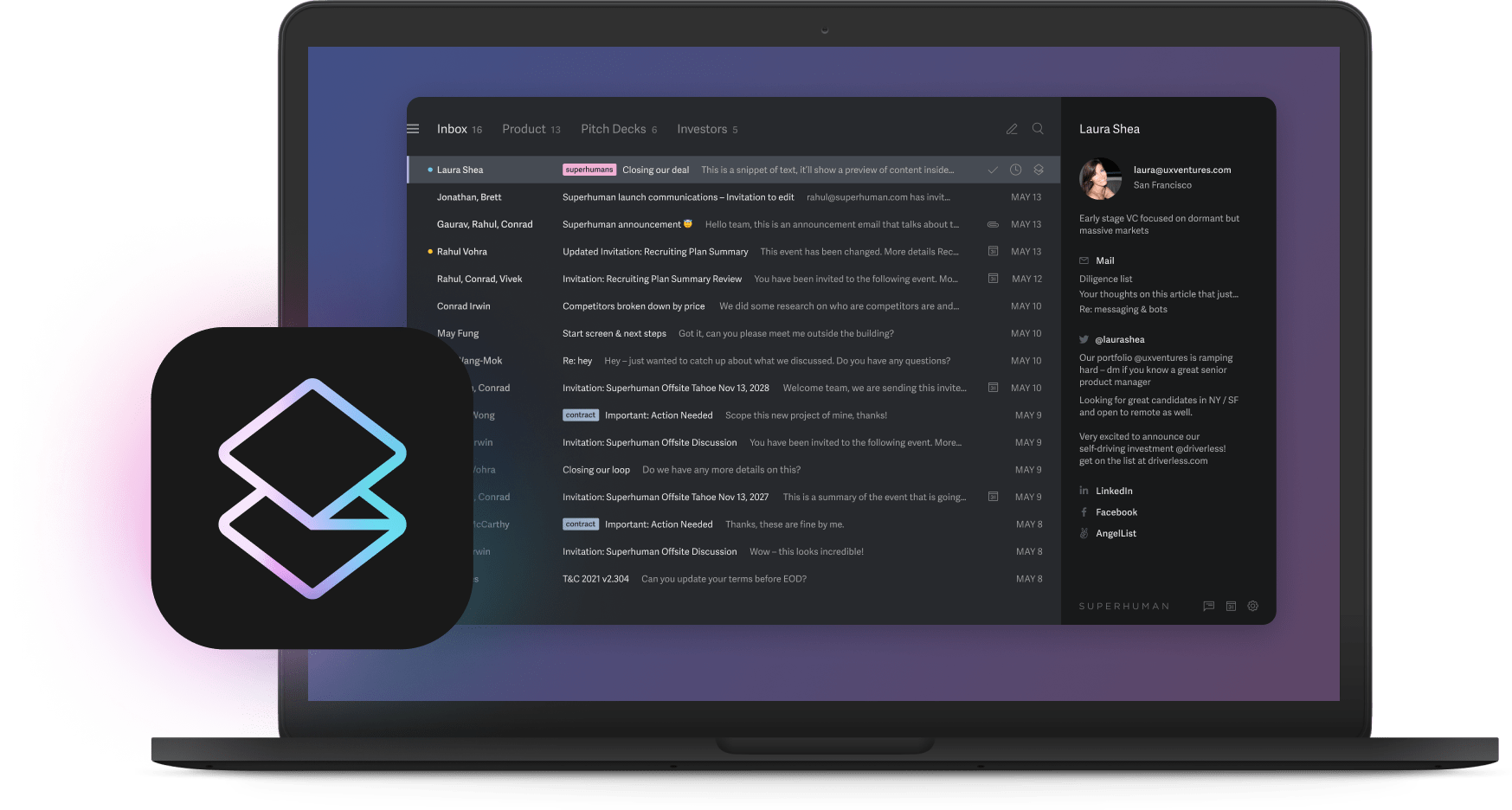

Maintaining this discipline requires the right infrastructure. Unlike traditional email clients, Superhuman's Split Inbox automatically separates investor outreach from team follow-ups, ensuring critical communications never get buried. The platform's Auto Reminders feature proactively nudges you before each KPI review, eliminating the scramble for numbers that plagues teams using basic email tools. These capabilities, unique to Superhuman, transform email from a time sink into an operational advantage.

Ruthless, data-first decision loops

Productivity gurus tell you to block "deep work" time. VCs prefer that deep work targets data, not inbox zero. Winning CEOs set a daily metric pulse that hits Slack by 9 a.m. They run weekly cohort analyses and pre-agree on kill thresholds, say any paid channel whose payback exceeds six months.

Growth investors drill into these processes. They expect cohort retention, CAC, LTV, burn, gross margin, and net revenue retention pulled straight from real-time dashboards. When churn jumps, they want meeting notes, the hypothesis, and the experiment planned for next sprint. Anything less feels like gambling.

A CEO once faced pushback on a 20 percent price hike in a partner meeting. She opened with a two-slide waterfall showing historical gross margin, scenario analysis, and a payback curve that dropped from eleven to seven months under the new pricing. The room went quiet, then nodded. Numbers won the day.

Perfectionism that once slowed Series A founders becomes a superpower here. You need uncompromising data hygiene, immediate feedback, relentless iteration. Your deep-work block now belongs to SQL queries and cohort charts.

To maintain this focus, you need tools that filter signal from noise. Superhuman's Auto Summarize instantly condenses lengthy product-analytics emails into actionable insights, a capability you won't find in Gmail or Outlook. While other teams drown in notification overload, Superhuman users process critical data alerts in seconds, keeping their attention on metrics that actually move the needle.

Systems that work without the founder

Planning tomorrow today works for your to-do list. To impress investors, the company needs to plan tomorrow without you. Autonomous systems start with documentation. You need decision trees for refunds, escalation paths for outages, SOPs for onboarding. Empowered leads approve budgets within limits. A shared knowledge base auto-updates from each sprint retro.

VCs call this reduction of "key person risk." They probe for clean delegation charts. They ask, "Could the business run for a month if the founder went offline?" Founders who answer yes by taking a two-week trip and returning to improved KPIs command premium valuations.

Building these autonomous processes requires deliberate effort. The biggest challenge? Creating systems that run smoothly without your constant input. Superhuman solves this with features that don't exist in standard email platforms. Auto Drafts automatically generates investor updates from your KPI dashboard, while Shared Conversations enables revenue leaders to collaborate directly in email threads without forwarding chains back and forth. When a new hire joins, Split Inbox filters onboarding emails into a dedicated stream, ensuring nothing critical falls through the cracks. These aren't add-ons or plugins. They're native capabilities that make delegation actually work.

Independent systems grant freedom. Freedom for you to step back, freedom for teams to step up, and freedom for investors to picture scale that won't collapse without you. This operational independence becomes your strongest signal that the business can thrive beyond its founding team.

Strategic board & stakeholder management

Many productivity lists tell you to encourage the team. Great CEOs apply that encouragement upward. Start with the board playbook. Send pre-reads 72 hours before meetings. Tag each slide R, Y, or G. Flag three focused "asks." Follow up within 24 hours with decisions, owners, and due dates.

Boards prefer this structure because it turns meetings into strategy, not status. Best-practice guidance recommends dedicated audit and comp committees to keep full sessions high-leverage. Transparency breeds trust. Brevity keeps directors engaged.

Confidence also means selective agreement. When a director suggests pivoting the product roadmap mid-quarter, a seasoned CEO thanks them, cites data, and when warranted, says no. That restraint signals control.

The right tools make governance effortless. Most CEOs cobble together board materials from scattered email threads and disparate documents. Superhuman changes this completely. Auto Summarize transforms lengthy stakeholder feedback into concise action items. Auto Reminders ensures pre-reads go out exactly 72 hours before meetings. The platform's triage capabilities route post-meeting replies directly to the right owners. These aren't features you'll find in Gmail or Outlook. They're purpose-built for leaders who understand that running the board with precision often decides who graduates from founder to CEO. When your governance feels as structured as your product sprint, investors see a company ready for the next orbit.

From founder-mode to CEO-mode

Tight operational rhythm, data-first decisions, autonomous systems, and smart board management show you're ready for scale. Each practice strengthens the others. Your Monday-to-Monday discipline signals control to investors. Ruthless metrics prove every move is grounded in evidence. Systems that run independently reduce key person risk. Sharp board engagement shows you can challenge and collaborate.

Most entrepreneur success lists focus on morning routines or inbox zero. VCs focus on whether your entire company runs with precision. Audit your weekly rituals, dashboards, delegation charts, and board packets. Keep what improves customer outcomes. Automate or document everything else. Walk into your next term-sheet conversation with numbers, playbooks, and a team that knows the plan by heart.

These practices shift the conversation from potential to proof. They move you from founder-mode to CEO-mode.

Adopt these practices early. Every funding round becomes less about personality, more about predictable performance. Carry them forward and they'll keep compounding long after your next raise, positioning your company and career for the kind of growth VCs eagerly back again and again.