Most AI projects fail for a simple reason. Companies build cool technology first and look for revenue later.

70-85% of projects end up as expensive experiments because enterprises invest billions in artificial intelligence, only to face disappointing returns and inefficiencies. The companies making real money from AI do the opposite. They start with a dollar amount they want to move, then work backwards to find the AI that gets them there.

This playbook shows you exactly how to flip from technology-first to revenue-first thinking, with frameworks that turn AI from a cost center into a profit driver within 12 to 18 months.

Why your AI investments are bleeding money

Your AI projects fail because they solve problems that don't generate revenue. While your data science teams optimize for model accuracy, competitors capture market share through AI that customers actually pay for. The mismatch between technical excellence and commercial viability explains why most enterprise AI initiatives never reach profitability.

Three patterns dominate every failing AI program. First, engineering teams build sophisticated models that solve interesting problems rather than profitable ones. CHROs warn that leaders must audit business cases before deployment, yet most organizations still approve projects based on technical merit alone. Second, impressive demonstrations secure budgets, but integration reality kills momentum when the gap between controlled demos and production complexity spans 12-18 months. Third, high-visibility AI initiatives generate press coverage while fundamental process improvements that could drive immediate revenue languish unfunded.

This bleeding accelerates under quarterly earnings pressure. Your board demands concrete ROI metrics while AI projects operate on longer development cycles, forcing premature scaling decisions that doom otherwise viable initiatives.

How to build AI that generates profit

Start with your P&L, not your algorithm

Revenue-generating AI begins with specific financial targets and reverse-engineers the minimum viable technology needed to hit those numbers. Manufacturing companies targeting 8% warranty claim reduction need predictive quality control systems, not general-purpose machine learning platforms. Financial services firms pursuing 15% faster loan approvals require workflow automation, not experimental deep learning models.

This commercial backcasting eliminates the guesswork that kills AI projects. Instead of asking what your data can do, you identify what customers will pay for and build only the AI capability required to deliver that value. Clean, focused datasets consistently outperform massive data lakes because they solve specific commercial problems rather than general technical challenges.

The methodology works because it shifts team incentives from technical sophistication toward measurable business outcomes. When every feature must directly impact revenue metrics, engineering teams naturally prioritize practical solutions over academic exercises.

Scale through proven value, not technical potential

Smart enterprises stage AI deployments to capture value incrementally rather than betting everything on transformational implementations. Start with 90-day pilots that generate measurable revenue through augmenting existing processes. A subscription business might deploy AI to identify customers likely to upgrade within 30 days, then track conversion lift from targeted outreach. Once you prove commercial viability, scale across broader user bases while implementing governance frameworks.

This progression solves the common problem of AI projects that work in labs but fail in production. Each stage has distinct success metrics tied to business outcomes rather than technical milestones. Advancement depends on demonstrated ROI rather than algorithmic sophistication, ensuring every dollar invested generates measurable returns.

Production scaling requires full security audits and regulatory compliance, but these become investments in sustainable competitive advantage rather than compliance overhead. The key is proving commercial value first, then building the infrastructure to scale profitably.

Protect your advantage through proprietary data

Sustainable AI advantages rely on exclusive data access rather than algorithmic superiority. Your competitors can hire similar data scientists and license comparable models, but they cannot easily replicate your unique datasets or customer relationships. Track competitor AI investments through hiring patterns and patent filings while building data moats they cannot breach.

Financial services firms monitor loan approval speeds and pricing algorithms to identify competitive threats early. Retail companies track recommendation engine sophistication and inventory optimization to understand market positioning. This intelligence helps you time AI investments to maximize competitive advantage while minimizing implementation risk.

The organizations that win build proprietary data assets through strategic partnerships, exclusive access arrangements, or unique data generation capabilities that create switching costs for customers and barriers for competitors.

What works in your industry

Financial services: Turn compliance into competitive advantage

Your regulatory constraints actually create AI opportunities that other industries cannot access. Anti-money laundering systems that reduce false positives by 40% save millions in investigation costs while improving customer experience. Credit scoring models that identify profitable customers missed by traditional approaches generate direct revenue while meeting regulatory approval requirements.

The key is positioning AI as risk reduction rather than pure revenue generation. Advanced fraud detection provides measurable ROI through loss prevention while satisfying regulatory requirements for security monitoring. These implementations create sustainable advantages because competitors must meet the same compliance standards, making your AI capabilities difficult to replicate.

Focus on operational risk reduction where AI delivers immediate value. Cybersecurity applications that prevent data breaches provide clear ROI measurement while building the governance frameworks required for revenue-generating AI initiatives.

Manufacturing: Optimize what you can measure

Your production environments offer the clearest AI ROI measurement through quality improvement, downtime reduction, and yield optimization. Predictive maintenance systems that reduce unplanned downtime by 25% generate immediate cost savings while improving equipment utilization. Computer vision quality control that identifies defects 80% faster reduces waste and rework costs while improving customer satisfaction.

Success depends on integration with existing manufacturing execution systems rather than standalone AI deployments. Supply chain optimization that combines demand forecasting with logistics planning creates value through inventory reduction and delivery performance improvement. These systems work because they solve specific operational problems with measurable financial impact.

Start with predictive quality control where defect reduction directly impacts profit margins. Once you prove value in controlled environments, expand to supply chain and maintenance applications that multiply operational efficiency gains.

Retail: Monetize customer understanding

Your customer data creates AI opportunities that directly impact revenue through improved acquisition, retention, and lifetime value. Recommendation engines that increase average order value by 15% generate measurable revenue while improving customer experience. Dynamic pricing systems that optimize margins while maintaining competitiveness create sustainable profit improvements.

The key is starting with customer-facing applications where AI impact can be measured through sales metrics. Personalization platforms that improve conversion rates provide immediate ROI while building the data assets needed for inventory optimization and demand forecasting. Customer service automation that resolves issues 60% faster reduces operational costs while improving satisfaction scores.

Focus on applications where customer behavior changes translate directly to financial outcomes. Search optimization and product recommendations offer the clearest path to revenue generation through improved customer experience.

How to implement without failing

Your 90-day success framework

Week 1-2: Conduct executive workshops to identify specific revenue targets that align with quarterly reporting cycles. Manufacturing executives might target 8% reduction in warranty claims, while retail leaders focus on 12% increase in cross-sell conversion. These sessions must produce specific dollar amounts tied to measurable business outcomes rather than general AI aspirations.

Week 3-4: Interview customers to validate commercial assumptions before building anything. Focus on willingness to pay for proposed improvements rather than general interest in AI capabilities. A logistics company considering route optimization must confirm that customers value faster delivery enough to pay premium pricing.

Week 5-8: Launch limited-scope implementations with clear success metrics and daily monitoring. Subscription businesses might test AI-driven upgrade recommendations with 10% of their customer base while tracking conversion lift against control groups. Technical performance matters less than business outcome measurement during this validation phase.

Week 9-12: Make data-driven scaling decisions based on demonstrated ROI rather than technical potential. Projects that generate measurable revenue within 90 days earn expanded investment, while those that show only technical progress get terminated or redirected.

This framework prevents the common failure mode where promising pilots never reach production due to unclear success criteria or insufficient business validation.

When to pivot or kill projects

Monitor user adoption rates, technical performance metrics, and business outcome trends weekly rather than quarterly. Declining engagement or performance that persists beyond 30 days typically indicates fundamental implementation issues that require immediate response. The speed of your pivot often determines whether projects can be salvaged or must be terminated.

Develop predefined decision frameworks for modifying scope, changing technical approaches, or reallocating resources when initial assumptions prove incorrect. A customer service AI that achieves 85% accuracy but generates customer complaints requires immediate pivot to human-in-the-loop systems rather than continued accuracy optimization.

Balance high-risk initiatives with incremental improvements that generate near-term value. Portfolio management principles apply to AI investments just like traditional capital allocation decisions. Failed experiments become learning opportunities only when successful projects generate enough revenue to fund continued innovation.

How to measure what matters

Beyond basic ROI calculations

Use controlled experimentation to isolate AI impact from other business changes occurring simultaneously. A/B testing, matched market analysis, and synthetic control groups provide more accurate ROI measurement than simple before-and-after comparisons that conflate AI benefits with seasonal trends or market conditions.

AI implementations often generate value across multiple business functions simultaneously. Customer service automation reduces support costs while improving sales conversion and customer retention rates. Comprehensive measurement requires tracking effects across all impacted areas rather than focusing solely on the primary implementation target.

Some AI benefits compound over time as models improve and user adoption increases. Financial modeling should account for learning curves and network effects rather than assuming static benefit levels. A recommendation engine that improves customer lifetime value by 8% in year one might achieve 15% improvement by year three through better personalization and increased data collection.

What to tell your board

Present AI initiatives using revenue impact, competitive positioning, and strategic option value rather than technical performance indicators. Your board understands market share protection and profit margin improvement better than model accuracy or processing speed metrics.

Align AI investment narratives with broader corporate strategy communications. Demonstrate how AI capabilities support long-term competitive advantages and market expansion opportunities rather than isolated efficiency improvements. Manufacturing companies position predictive maintenance as supply chain resilience enhancement rather than equipment optimization.

Maintain documentation standards that satisfy audit requirements while protecting proprietary methodologies. Balance transparency obligations with competitive advantage preservation by focusing on business outcomes rather than technical implementation details.

How to build lasting competitive advantage

Create data moats competitors cannot cross

Systematic collection and curation of proprietary datasets that competitors cannot replicate creates sustainable advantages through strategic partnerships, unique access arrangements, or exclusive data generation capabilities. Financial services firms with exclusive credit bureau relationships or retailers with detailed customer preference data maintain AI advantages regardless of technical sophistication.

Develop internal expertise in AI strategy and implementation rather than relying entirely on external vendors. Business leaders need AI literacy to make informed investment decisions while technical teams require business acumen to focus on commercially valuable applications. This organizational capability becomes your primary competitive differentiator.

Position AI capabilities as essential components of broader business ecosystems. Platform strategies that embed AI into partner and customer workflows create switching costs that protect market position even when competitors develop similar technical capabilities.

Future-proof your AI investments

Design AI architectures that can incorporate new models and approaches without requiring complete system rebuilds. Standardized data pipelines, modular inference systems, and vendor-agnostic integration frameworks protect against technology obsolescence while enabling rapid capability enhancement.

Focus internal training on AI strategy and implementation management rather than specific technical skills that become obsolete quickly. The organizations that succeed with enterprise AI treat it as a strategic capability rather than a technology implementation, requiring sustained focus on commercial outcomes and competitive positioning.

Maintain relationships with multiple AI vendors and service providers to avoid technology lock-in while ensuring access to cutting-edge capabilities. Balance cost optimization with strategic flexibility by treating vendor relationships as portfolio investments rather than single-source dependencies.

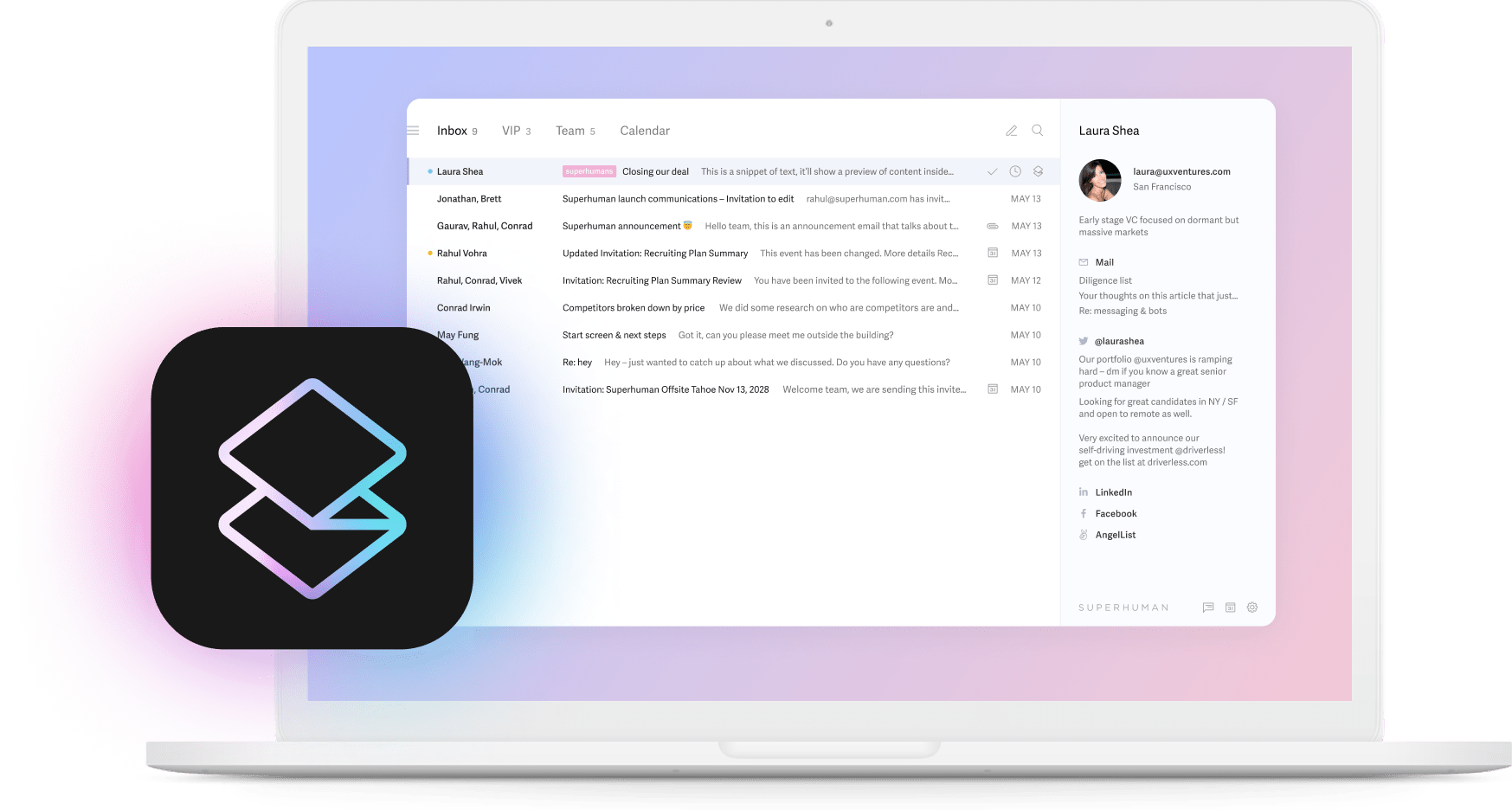

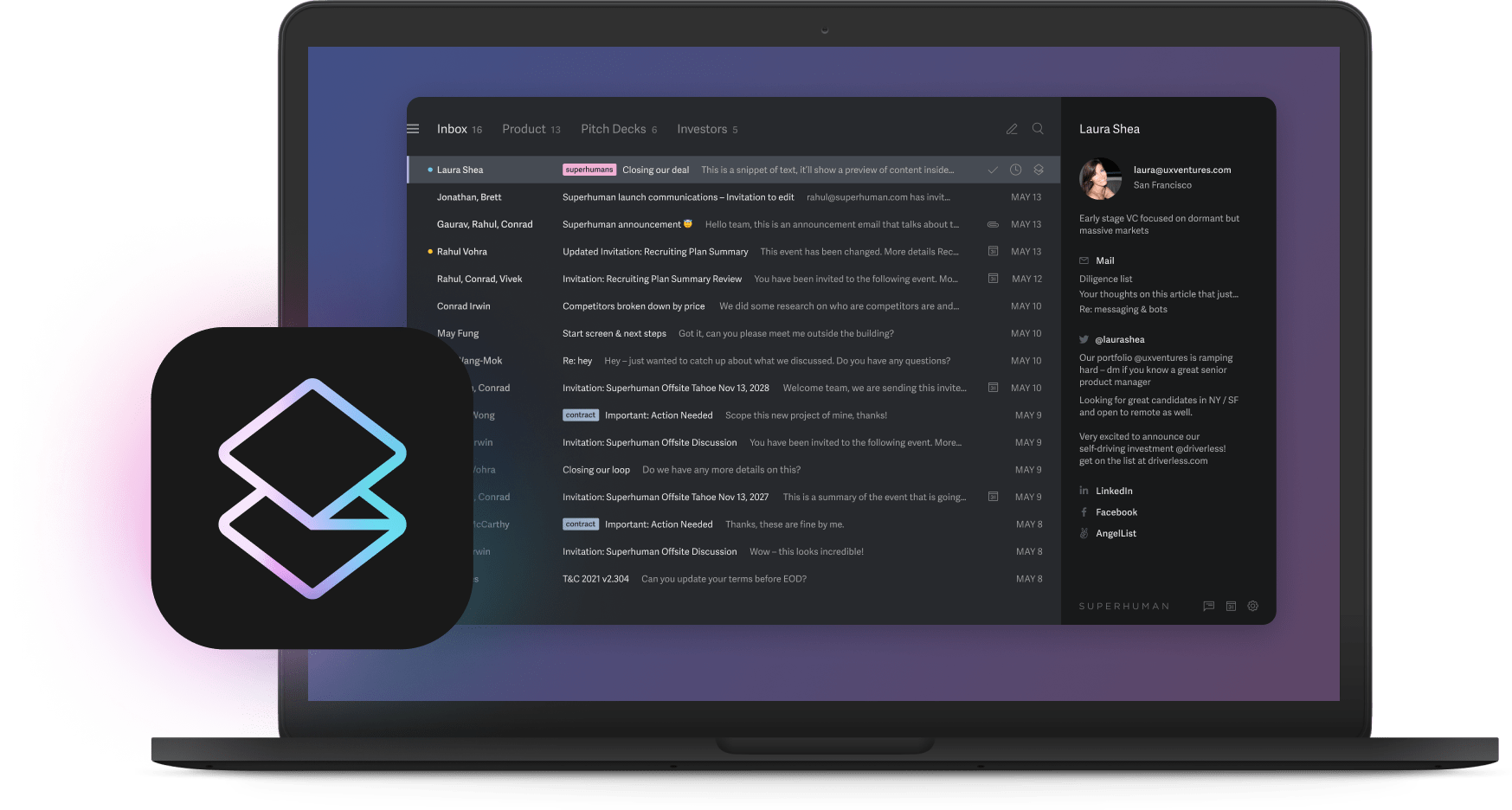

Think about email productivity, where professionals spend more than half of every workday in communication tools. Superhuman demonstrates sustainable AI value creation by focusing on measurable productivity improvements. Users save one full workday weekly through features like Write with AI and Auto Summarize. These aren't vanity metrics but business outcomes that justify premium pricing and drive customer expansion, proving that revenue-first AI strategies create lasting competitive advantages.