Companies are celebrating AI productivity gains in specific tasks. Yet our research shows that most professionals already save 1 day a week with AI. The most successful companies don't just pocket the time savings. They reinvest those hours into strategic initiatives that transform their business.

Leading companies already know that AI excels at clearly defined tasks but offers little advantage beyond those boundaries. When organizations limit their ambitions to efficiency metrics, they miss the real opportunity. The saved hours aren't the prize. What you do with those hours determines whether you lead or follow.

The pattern is clear across industries. Companies winning with AI treat productivity gains as fuel for discovery. They use freed capacity to identify unmet customer needs, prototype new business models, and make strategic moves their competitors haven't imagined. This shift from measuring time saved to creating new value separates companies that grow from those that simply run faster in place.

When "efficiency" killed a giant

Several Fortune 500 companies deployed AI tools between 2017 and 2020 that improved efficiency dramatically. They reduced processing times, cut support costs, and eliminated thousands of jobs. The dashboards looked great. Then AI-native startups crushed them.

These companies focused entirely on automating repetitive tasks while starving creative and strategic work. Product roadmaps froze. Customer insight programs died. Data teams perfected dashboards tracking "tickets closed per hour" instead of discovering what customers actually wanted. Meanwhile, new competitors used machine learning for discovery, not just efficiency. They created products the giants never imagined and stole market share while the incumbents celebrated their productivity metrics.

The lesson is brutal but clear. Automating the easy work without reinvesting in innovation leaves you vulnerable to competitors who use AI to see around corners. If your dashboard shows productivity wins but your market share is slipping, you're already losing.

Why AI-driven productivity is the wrong north star

You know the metrics: hours saved, emails sent, calls logged. They feel concrete, but they lock you into yesterday's game. AI makes this trap deeper by automating the obvious and inflating numbers while the real opportunity slips away.

Traditional KPIs miss quality, creativity, and strategic impact. When you obsess over utilization or output per employee, you perfect an obsolete model. AI widens this illusion because it excels at automating routine tasks but also creates new work. It floods inboxes with drafts and memos needing human review. Your "messages processed" metric surges while real insight stands still.

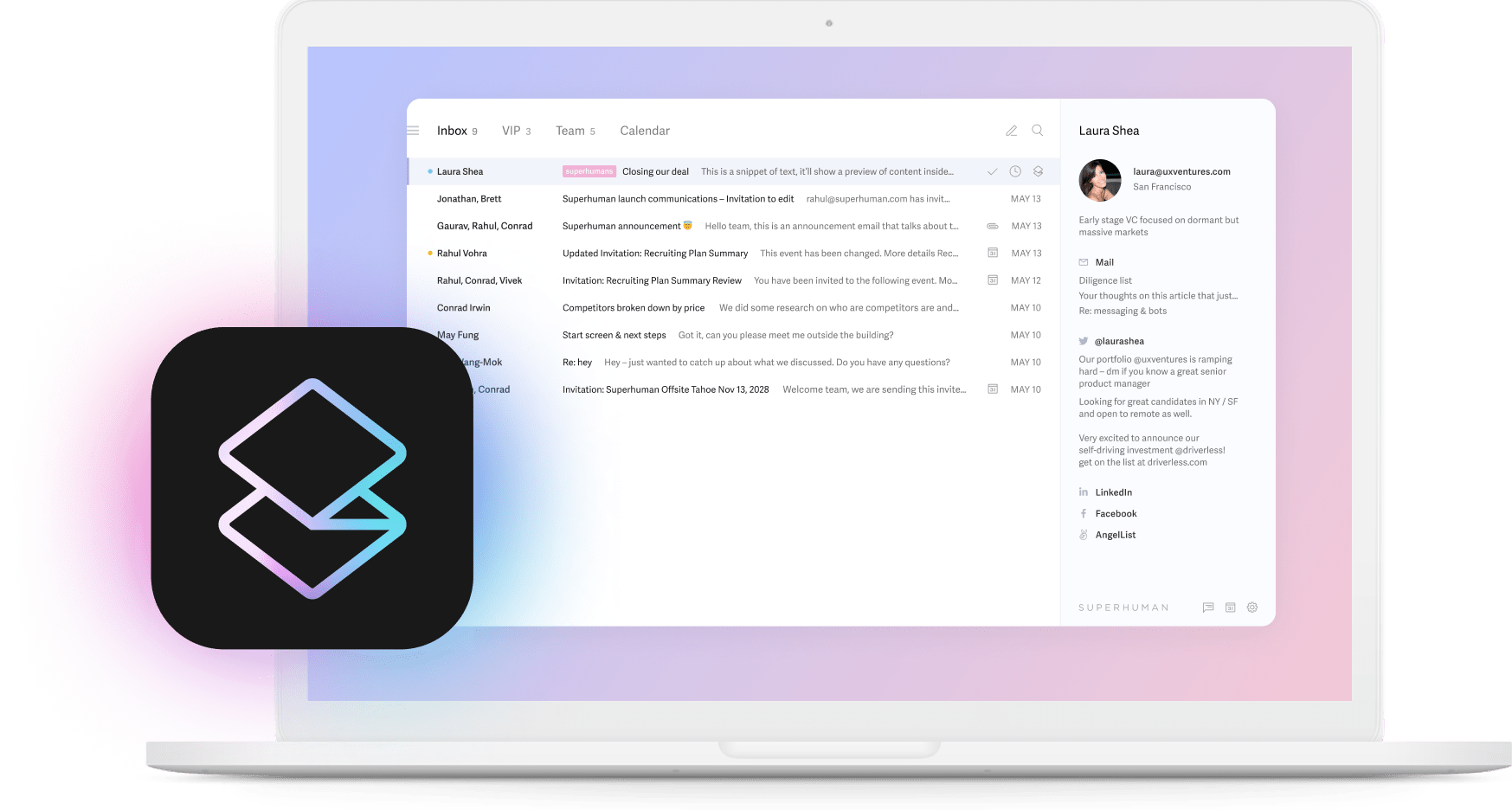

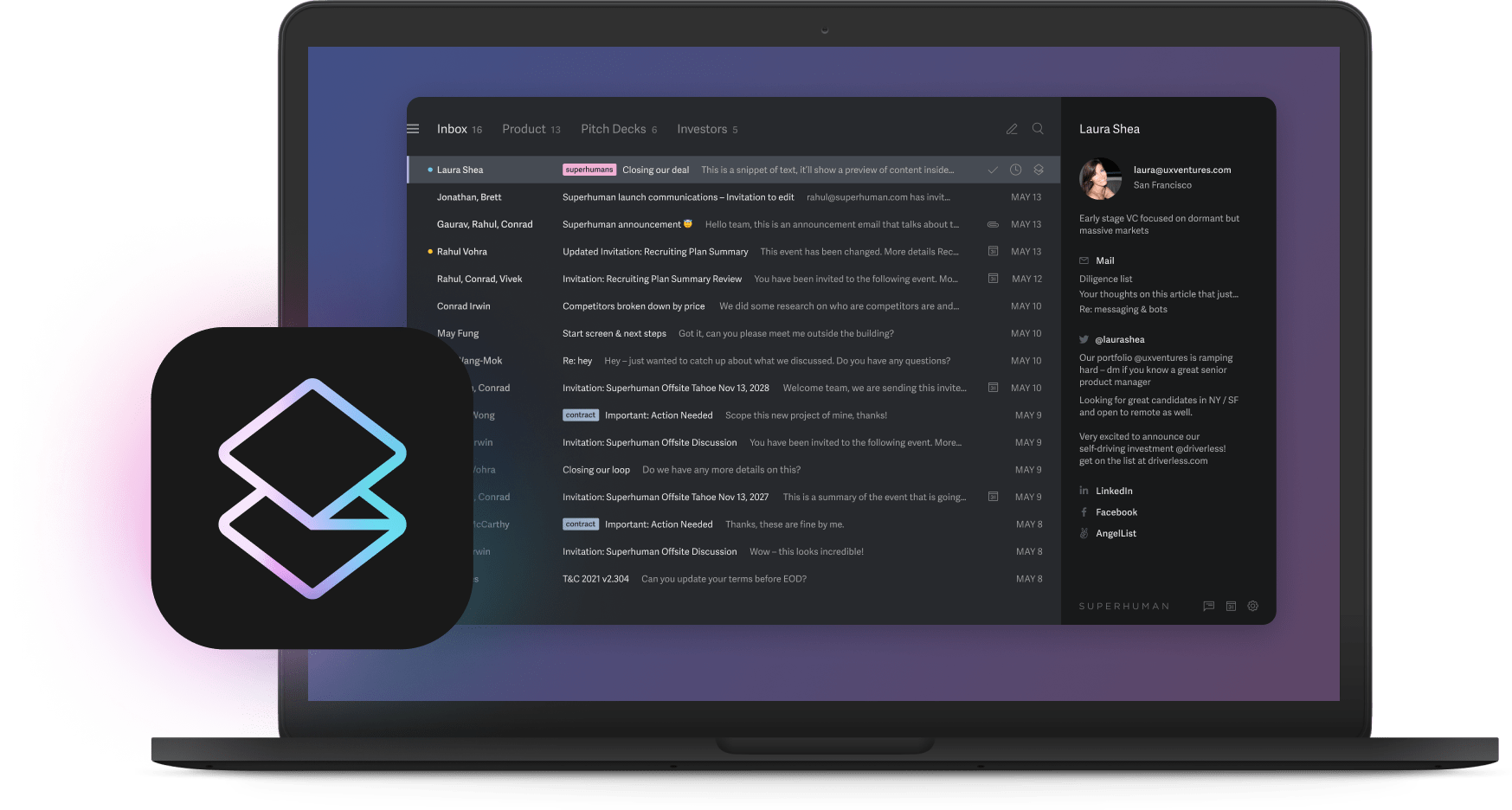

Market leaders flip this script entirely. They treat AI-freed time as investment capital for bold bets. Take Superhuman's approach with Split Inbox. The team initially helped customers handle twice as many emails, then deliberately slowed down to test conversation segmentation. Productivity dipped during experimentation, but the payoff was strategic differentiation. This willingness to sacrifice short-term metrics for long-term advantage separates winners from those just running faster in place.

The busy-work automation lie

Chasing quick wins with automated tools feels great until you realize you've only automated the obvious. AI races through template replies while struggling with judgment and strategy. When you automate easy work, the harder, value-creating work becomes even more critical.

Most companies stop at surface automation. Help desks use chatbots. Marketing auto-generates copy. Finance schedules reports. These moves look good on dashboards but rarely shift competitive ground. Worse, generative models often increase total workload by flooding teams with drafts needing review. You save time on creation just to spend it on oversight.

This automation blindness lets competitors steal your future. While you celebrate faster email support, rivals deploy dynamic pricing that reshapes markets. The productivity badge masks strategic drift. Time spent on discovery and creative leaps creates new categories. Strip those away and you lose the ability to spot shifts and design bold bets. Automation only works when you reinvest freed capacity into market intelligence and customer exploration. Otherwise, you're just lightening the to-do list while competitors reinvent the game.

The efficiency death spiral

Hit every efficiency target and watch growth stall anyway. That's the efficiency death spiral, where impressive metrics hide your slide toward irrelevance. AI automates what's easy to measure while leaving nuance and judgment on your plate. The hidden rework from reviewing AI output drags momentum and distracts talent from strategic work.

Worse, automation strips away complexity that creates competitive advantage. Cookie-cutter outputs replace nuanced decisions. Rivals don't need to match your capabilities anymore. They just reintroduce the human judgment your algorithms removed. Meanwhile, capital freed by efficiency cycles into buybacks and cost cuts instead of bold experiments. AI highlights structural weaknesses rather than curing them.

Before celebrating time saved, ask whether those hours fuel market-making ideas or simply vanish from budgets. Productivity gains mean nothing if they don't translate into growth and innovation.

The productivity paradox that tanks valuations

Investors reward growth stories, not time-saved metrics. Pour AI talent into shaving minutes off workflows while your market stays flat, and venture capital sees a business getting faster at a shrinking game.

Traditional efficiency KPIs signal that your strategy hasn't changed. You're perfecting yesterday's process while missing tomorrow's opportunity. When companies show paths to new markets through AI-driven tools, valuations expand. Capital chases teams using AI to unlock revenue, not just efficiency.

The pattern is predictable. Established vendors celebrate chatbot deployments while revenue flatlines. Meanwhile, competitors pause features to build AI-native products that open adjacent markets. Short-term productivity dips lead to long-term valuation jumps. One expands what they sell while the other automates work customers never valued. Use AI to expand markets and iterate faster. That's the story investors fund.

How your competition exploits your productivity obsession

While you optimize email workflows, competitors use AI to create new value. They feed millions of data points into models that surface hidden opportunities in hours. They run thousands of daily pricing tests while you hold weekly meetings. They identify and recruit your top talent before they even start looking.

Each move exploits blind spots created by productivity tunnel vision. Competitors pair machine learning with new channels and open ecosystems. Voice interfaces and real-time APIs expand reach beyond incremental gains. Your efficiency improvements become their opportunity to reinvent entire categories.

Alternative metrics that actually matter

Hours saved tells investors nothing about future viability. You need metrics built for market creation: Market-creation velocity tracking idea-to-customer speed. Blind-spots discovered counting unknown opportunities AI surfaces. Customer insight rate measuring actionable discoveries. Strategic pivots enabled from algorithmic findings. New revenue streams from AI-revealed business models.

These metrics shift focus from squeezing processes to inventing advantages. They force reinvestment of efficiency gains into experimentation and rapid iteration. Your scoreboard evolves from rear-view mirror to radar for future markets.

Weaponize AI for market creation

Turn automation from cost-cutter to category creator by questioning industry assumptions. Hotels needed front desks until Airbnb. Taxis needed drivers until Uber. Every sector has similar "truths" waiting to be shattered.

Your playbook: Spot outdated assumptions where human effort looks like tradition. Mine data for patterns competitors miss. Prototype ideas even if they slow current throughput. Reinvest efficiency gains into rapid market tests. Build algorithmic moats with proprietary data as ideas mature.

Your 30-day start: Audit automation as tactical or strategic. Identify three customer blind spots. Budget for two market experiments. Form cross-functional AI teams. Set market-creation metrics. Ask weekly: "Did this expand our market or polish the old one?"

Next steps for leaders

Stop chasing vanity KPIs. Replace activity metrics with market-creation measures. Assign someone to turn automation into category-creating bets. They'll unite product, data, and finance teams while protecting experimental budgets.

Audit every automation project. Keep only what enables strategic experimentation. Bring three questions to your board: Are we creating markets or saving time? What percentage goes beyond basic automation? How fast can savings become strategic bets?

87% believe AI is necessary for competitive advantage, yet top performers save 14% more time because they use it strategically. With 66% expecting 3x productivity gains in five years, the question isn't whether AI transforms work, but whether you'll use it to save time or dominate markets.

Stop counting hours. Start counting the markets you'll own.